Market Monday: Grand Rapids, MI

MARKET OVERVIEW

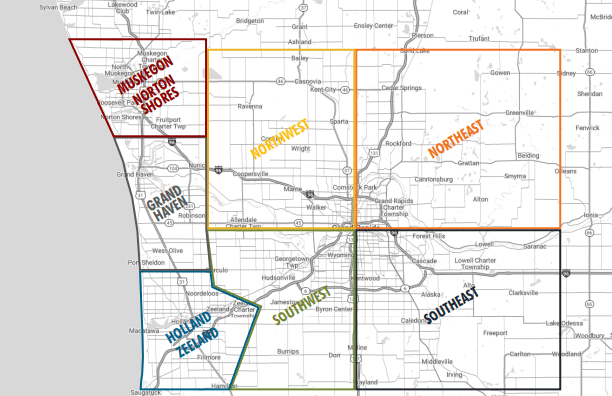

Grand Rapids

Grand Rapids earned recognition from The Economist as “the most successful intensive manufacturing city in America,” in 2020 with West Michigan home to over 2,500 manufacturers and 133,000 manufacturing jobs—the highest concentration per capita of any large U.S. metro.1 The region’s industrial base spans office furniture, automotive, medical devices, aerospace, and food and beverage production.2 This manufacturing depth is complemented by other tailwinds: Grand Rapids leads the Midwest in population growth with an 8% increase over the past decade, and private businesses grew by 33.3% from 2013 to 2023—the highest rate among major Midwest metros.3

The Grand Rapids, Michigan IOS market experienced steady tenant and buyer demand throughout 2025, supported by a diverse manufacturing base and continued industrial activity across West Michigan. While the broader industrial market entered a period of adjustment, limited availability of functional outdoor storage sites and disciplined new supply have helped sustain long-term IOS fundamentals in the region.4

Grand Rapids functions as a critical logistics and service hub in West Michigan by combining access to major interstate corridors including I-96, I-196, and US-131 with proximity to Gerald R. Ford International Airport and established regional rail networks. This infrastructure supports freight, manufacturing, and service activity across Michigan and the broader Midwest, positioning Grand Rapids as a regional base for construction, building materials, equipment rental, and fleet-based operators.

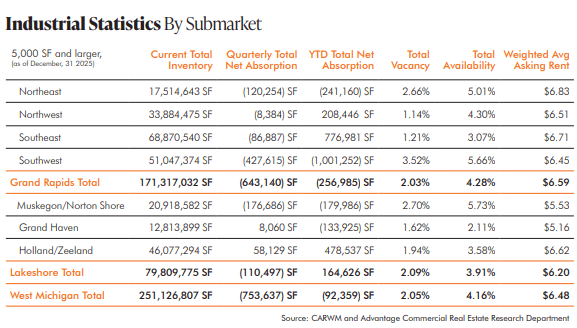

Recent industrial momentum reflects a market in transition rather than retreat. While net absorption turned negative in 2025 due largely to returned manufacturing space in select submarkets, leasing demand for functional warehouse and distribution facilities near major transportation corridors remained resilient. Vacancy rose modestly but continues to sit well below national averages, underscoring the relative health of the West Michigan industrial market.

As the region evolves, competition for well-located IOS sites is expected to intensify. Development activity has slowed significantly, with new construction largely limited to build-to-suit projects, while limited infill land and zoning constraints across municipalities restrict the delivery of new outdoor storage product. These dynamics continue to favor existing, well-located IOS sites with strong access, circulation, and operational layouts.

Rent performance across the Grand Rapids industrial market continues to diverge by product type. While overall asking rents softened slightly year over year, flex and specialized industrial properties continue to command premiums, reflecting sustained demand for smaller, functional, and operationally flexible space. This divergence reinforces the resilience of IOS and yard-oriented service sites, which sometimes compete with flex and general-purpose industrial product and benefit from similar demand drivers.

IOS OVERVIEW

Grand Rapids IOS Opportunity

Tim Van Noord, SIOR, Partner at Advantage CRE, notes that “while the nation’s largest LTL carriers all have a presence in Grand Rapids, recent IOS demand has been driven primarily by contractor, ecommerce, and heavy equipment users seeking equipment storage and laydown yards. Given its peninsular location, the region is not a traditional logistics hub; at its core, Grand Rapids is a manufacturing community, and many of the LTL carriers operating here support local manufacturers or use the market as a base to serve Northern Michigan.”

Lease rates initiated over the last three years generally range from approximately $2K to $3K per acre per month, with an average of $2,500 per acre per month. Over the past two years, sale prices have ranged from roughly $175,000-$250,000 per acre, with an average around $200,000 per acre.

Van Noord adds that “aside from an extremely tight inventory, with vacancy under 2 percent, one of the biggest challenges in the Grand Rapids IOS market is finding well-located, industrial-zoned land that can support outdoor storage uses. This scarcity limits options for tenants seeking functional yards with appropriate access, circulation, and zoning certainty.”

Long-term IOS fundamentals in Grand Rapids and across West Michigan remain strong. Durable demand from manufacturing, construction, heavy equipment, and contractor-oriented users continues to support the sector, while tight inventory, limited infill land, and zoning constraints restrict new supply. As a result, well-located, functional IOS sites with clear industrial zoning, strong access, and efficient operational layouts continue to outperform, even as less competitive sites face longer downtime and increased pricing sensitivity.

FEATURED LISTINGS

Grand Rapids

Advantage CRE

Please reach out to Tim Van Noord, SIOR for more information on the below.

FOR SALE: 5685 Comstock Park Dr NW is a five-building industrial site totaling approximately 59,700 SF on 9.39 acres in Comstock Park, MI, offering a rail-served layout with direct access to Alpine Avenue and Highway I-96. The property features heavy power, 14 dock-high doors, 16' clear height, and flexible building configurations well suited for contractors, building supply, trucking, and vehicle-related users. The site is priced at $2.4 million, or approximately $40.25 per square foot, presenting a functional yard-oriented opportunity in a supply-constrained West Michigan market.

FOR LEASE: 1252 142nd Ave in Wayland, MI is a build-to-suit industrial opportunity offering 24,000 SF on approximately 5.1 acres within a new industrial park just off US-131. The site is designed with IOS functionality in mind, featuring fenced yard storage, drive-through access, overhead doors, 24' clear height, heavy power, and crushed concrete outdoor storage. Asking rent is $14.95 PSF NNN, positioning the project as a rare, purpose-built IOS option in a supply-constrained West Michigan market.

FOR SALE OR LEASE: 10151 S Division Ave in Byron Center, MI is a fully fenced, 65,715 SF cross-dock facility situated on approximately 22.4 acres with extensive paved yard and trailer parking. The property features 109 dock doors, 6 drive-in doors, 16' clear height, dedicated car and trailer parking, and direct access to US-131, positioning it well for trucking, logistics, and fleet-oriented users. The site is available for lease at $11.95 PSF NNN or for sale at $9.0 million, offering a rare large-scale yard-intensive opportunity in the Grand Rapids market.

LOCAL EXPERTS

Local Brokers & Market Experts

Big thanks to all participants who helped shape this week’s Market Monday in Grand Rapids. If you’re looking to buy, sell or lease in Grand Rapids, the people below are the ones to call!

Advantage CRE

Tim Van Noord, SIOR

Partner

Advantage CRE

[email protected]

616.327.2800

SOURCES & REFERENCES

The Right Place - Advanced Manufacturing in Greater Grand Rapids (Link)

Experience Grand Rapids - Why the Grand Rapids Region is Home to Over 2,500 Manufacturers (Link)

Grand Rapids Chamber - State of the Region Report (Link)

Colliers Q4 2025 Industrial Report (Link)

Advantage CRE Industrial Report (Link)

IOS Resources

Check Out Our Free IOS Underwriting Model Tool

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.