YardDogs -

We’re highlighting the top industrial outdoor storage (IOS) leases and sales every week and in this edition, we cover transactions in Texas, California, Massachusetts and more.

In today’s email:

Transactions: Acquisitions in MA, TX (2), CA, and IL! Plus lease signed in OH.

On the Market: Site for lease in Fort Myers, FL — a 3.45-acre IG-zoned industrial yard with dual gated access, 2,500 SF office, efficient truck flow, and prime proximity to US-41, I-75, and RSW.

Recs: IOS Investor Interest from JLL

CLOSED TRANSACTIONS

Acquisitions & Dispositions

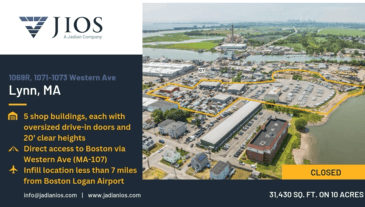

ACQUISITION: Jadian IOS closed on 1069R, 1071–1073 Western Ave in Lynn, MA, a 10-acre infill site featuring 31,430 SF across five shop buildings. The properties offer oversized drive-in doors, 20’ clear heights, and direct access to Boston via MA-107. Strategically located less than seven miles from Logan Airport, the site provides scale and accessibility in a tightly constrained market.

ACQUISITIONS: Triten Real Estate Partners expanded its Houston portfolio with the acquisition of two IOS sites totaling 6.8 acres. The properties, located at 6880 & 6890 McHard Road in Southwest Houston and 6410 Langfield Road in Northwest Houston, provide strategic access to SH 288, Beltway 8, and Highway 290.

ACQUISITION: Realterm acquired 8542 Slauson Avenue, a 4.2-acre IOS facility in Pico Rivera, CA. The property includes 21 ground-level loading doors, 20’ clear heights, a fueling station, and dual ingress/egress points, with Home Depot as the current tenant. Realterm noted the site’s strategic positioning and infrastructure align with its focus on transportation-critical assets in supply-constrained markets.

ACQUISITION: CanTex Capital acquired 3301 W. Kingsley Rd in Garland, TX, a 76,169 SF manufacturing facility on 7.82 acres. The property was purchased through a sale-leaseback with Weathermatic and includes 3.5 acres of excess land suitable for IOS use. Located just off I-635 with strong highway access, the acquisition reflects CanTex’s focus on manufacturing and IOS assets across DFW’s infill markets.

ACQUISITION: Zenith acquired a 5-acre site with a 50,000 SF warehouse at 9809 Industrial Dr. in Bridgeview, IL. The transaction was sourced by Meridian Capital Group and adds to Zenith’s growing Chicago portfolio. The property offers scale and functionality in a key industrial submarket, supporting future IOS growth.

LEASES SIGNED

Recently Leased Properties

LEASED: SqFt Commercial leased 3240 Production Dr. in Fairfield, OH, a 118,400 SF industrial facility on over 5 acres. The property features a 14,400 SF warehouse, 4,000 SF office, and 3+ acres of prime truck/trailer storage with heavy-duty concrete and a recycled asphalt yard. Marketed as a high-powered truck-ready IOS hub, the deal highlights strong demand for specialized truck maintenance and storage facilities.

ON THE MARKET

For Lease

FOR LEASE: 17280 Jean St in Fort Myers, FL. 3.45-acre, fully fenced/crushed-gravel industrial yard with dual gated access plus a refreshed 2,500 SF modular office (1996) and 13 paved parking spaces. IG (Heavy Industrial) zoning—ideal for material storage, laydown, equipment rental, or truck/trailer parking. Efficient truck flow (separate in/out) and prime access: 1.7 mi to US-41, 2.4 mi to I-75, 7.8 mi to RSW. Surrounded by national/regional operators in a high-growth pocket of Fort Myers.

Reach out to Mark Williams for more information: (407) 406-3187 • [email protected]

View OM | Video Overview

RECS

Investors Diving Into IOS

JLL highlights how institutional investors are rapidly moving into industrial outdoor storage, calling it an “early innings” asset class with strong opportunities for growth.

New to IOS?

Start with our guide: What is Industrial Outdoor Storage?

Check Out Our Underwriting Model: Underwrite IOS in Under 2 Min — No Spreadsheet Required

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.