YardDogs -

In today’s email:

Transactions: Acquisitions in NC (2), CO (2), FL, PA. Leases signed in TX and NJ.

On the Market: 4 listings

Recs: Check out the LA Times piece on IOS

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

CLOSED TRANSACTIONS

Acquisitions / Dispositions

ACQUISITION: Shoreline Capital completed an off-market acquisition of 290 Executive Park Drive NE in Concord, NC, a multiple acre IOS-oriented asset with two industrial buildings. Located at the I-85 and US-29 interchange, the property benefits from limited supply and strong regional fundamentals driven by rapid population growth in Concord and Kannapolis.

ACQUISITION: Kenai Capital Advisors represented the seller in the sale of a 26,950-square-foot industrial service facility on 9.98 acres at 2001 West 64th Lane in Denver to Alterra IOS. The fully leased property sits in Denver’s supply-constrained Northwest submarket, features specialized maintenance infrastructure and secured yard space, and offers immediate access to I-76, I-70, and I-25, making it well suited for equipment servicing and fleet operations. The transaction highlights continued investor demand for irreplaceable infill IOS and industrial service assets amid limited zoning, tight vacancy, and sustained rent growth in the Denver market.

Check out our recent Denver IOS Market Report for more information on the Denver market and current active listings

ACQUISITION: EML Realty Partners acquired an eight-acre IOS site at 8456 Orange Ave in Fort Pierce, FL for $3.2 million, totaling 348,480 square feet of paved, fenced, and lighted yard space. The fully occupied property is leased to national tenants The CDL Schools and Park My Fleet and is strategically located between I-95 and the Florida Turnpike in the St. Lucie County submarket.

ACQUISITION: Matterhorn Venture Partners acquired a 2.31-acre IOS property at 5081–5099 S. Rio Grande Street in Littleton, CO, featuring 15,000 SF of improvements in the highly supply-constrained Southwest Denver submarket. Concurrent with the acquisition, MVP executed a fully committed 10-year NNN lease with a national equipment rental tenant, providing long-term stability, renewal options, and purchase optionality. The transaction marks MVP’s first acquisition in Denver.

ACQUISITION: Colliers successfully completed the sale of an ±89,683 SF industrial building on ±7.3 acres at 4330 Chesapeake Drive in Charlotte, NC, representing the buyer in the transaction. The property, zoned ML-2, includes an IOS yard and is now being marketed for lease, offering rare infill industrial space with outdoor storage capability. The deal highlights continued demand for flexible industrial sites within Charlotte’s core industrial submarkets.

ACQUISITION: Stream Capital Partners has closed a multi-state industrial outdoor storage portfolio sale-leaseback involving a private equity-sponsored operator. The transaction attracted multiple offers and ultimately closed above asking price, highlighting strong investor appetite for IOS portfolios with embedded operating businesses.

ACQUISITION: Realterm acquired 925 N Godfrey Street, a fully leased industrial outdoor storage (IOS) facility in Allentown, PA, reinforcing its focus on transportation-oriented logistics assets. The property supports fleet maintenance and last-mile operations and benefits from strong access to the Lehigh Valley’s regional transportation infrastructure. The transaction was facilitated by JLL’s Industrial Capital Markets team.

LEASES SIGNED

Recently Leased Properties

LEASED: An affiliate of Ruggiero Seafood Inc. has signed a new lease in Newark as part of an expansion of its regional cold storage operations. The transaction, arranged by Advance Industrial Group, involves the former Newark Bay Cogeneration Powerplant at 449 Doremus Ave./414 Avenue P, providing added capacity and operational flexibility.

LEASED: Ocotillo Capital Partners has successfully leased a specialized Industrial Outdoor Storage (IOS) facility at 5560 Rittiman Road in San Antonio, with Cushman & Wakefield representing the landlord. The project highlights the successful development and lease-up of a purpose-built IOS asset to an international credit tenant.

ON THE MARKET

For Sale / For Lease Listings

FOR SALE: 1.7-acre net-lease property just outside the St. Louis MSA, located 11 miles from the I-270 / I-255 interchange. The site is leased to Sunbelt Rentals, a nationally recognized equipment rental operator with over 1,200 locations across the U.S. Fewer than 10 Sunbelt Rentals properties are currently available on the market, making this a rare opportunity to acquire a well-located IOS-oriented asset backed by a strong credit tenant. Reach out to Sarah Gerbick for more info.

FOR LEASE: This 12.83-acre truck maintenance facility in Daleville, IN offers two large buildings totaling nearly 43,000 SF with excellent highway access just off I-69. The site is fully paved with ample outdoor storage and a large pylon sign along SR-67, making it ideal for transportation, maintenance, or fleet users. With commercial zoning and strong visibility, the property provides a functional, move-in-ready solution for operators needing scale and accessibility. Reach out to Adam Stephenson and Mitchell Ayers for more info.

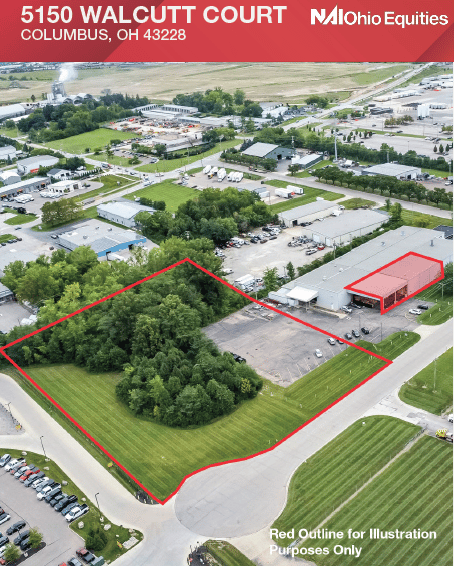

FOR LEASE: This ±3.5-acre site in Columbus offers a 6,500 SF building with 20' clear height, full utilities, and 340 feet of frontage on Walcutt Court. With LM2 manufacturing zoning and flexibility for truck parking, trailer storage, or equipment leasing operations, the property is well-suited for transportation and service-oriented users. Its proximity to I-70, I-270, and Downtown Columbus provides strong regional access and operational convenience for fleet or logistics groups. Reach out to Stephen Pryor and Simon Kroos for more info.

FOR SALE OR LEASE: This ±5.98-acre freight terminal site in North Las Vegas offers an 18,250 SF terminal, a 2,300 SF warehouse, and 1,850 SF of office space, all less than five minutes from the I-15. The property features 48 dock-high loading positions, an above-ground fueling island, a fully secured yard with 7,000V fencing, and IL zoning suited for transportation and logistics users. With excellent access to the Las Vegas Strip, Harry Reid International Airport, and major freight corridors, the site is well positioned for both owner-users and tenants seeking a functional, high-capacity terminal location. Reach out to Zach McClenahan and Jerry Doty for more info.

RECS

Recs

Once a niche real estate segment, outdoor storage has surged in Southern California as demand from logistics, fleet, and service operators accelerates — highlighted in a recent Los Angeles Times feature.

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,200+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.