YardDogs -

In today’s email:

Transactions: Acquisitions in TX (4), VA, TN, AZ. Plus Lease signed in VA!

On the Market: 3 listings

Recs: United Rentals Tops $16 Billion in 2025 Revenue

Have active IOS listings? Send to [email protected]

CLOSED TRANSACTIONS

Acquisitions / Dispositions

ACQUISITION: A ±3-acre IOS facility at 3104 S Rigsbee Drive in Plano, Texas was acquired. The transaction was led by Tyler Markwood and Karson Conrad and reflects continued investor demand for IOS assets in the Plano submarket.

ACQUISITION: Deronda Corporation acquired 7240 I-10 in San Antonio, Texas, a 20,000-square-foot warehouse on 3 acres with direct frontage along Interstate 10, a key logistics corridor between San Antonio and Houston. The purchase marks the firm’s first acquisition in Texas and an expansion of its industrial outdoor storage platform. A capital improvement plan is underway to enhance the property and position it for new logistics tenants.

ACQUISITION: 458 N WW White Road in San Antonio, TX has closed, totaling 3.55 acres with a 16,833-square-foot industrial building featuring drive-in bays, 3-phase power, secure fencing, and ample concrete yard. Located in the city’s East Side industrial corridor near I-10, Loop 410, and San Antonio International Airport, the property offers strong logistics access and expansion potential. Alterra IOS acquired the asset, marking another strategic addition to its industrial outdoor storage portfolio.

ACQUISITION: Capital Bay Partners acquired 450 E Irvington Road in Tucson, AZ, a 45,000-square-foot industrial outdoor storage property situated on 10.93 acres. The asset features 8 roll-up doors, an active rail spur, and direct access to I-10, and is fully leased to US LBM Holdings, a national building materials distributor.

ACQUISITION: Transport Properties acquired 1120 Foster Avenue in Nashville, TN, a 15,000-square-foot warehouse and repair facility situated on 2.84 improved acres. The fully leased asset features nine oversized drive-in doors, secure fencing, and heavy industrial zoning that permits outdoor storage, making it well-suited for transportation and service users. Located within Nashville’s Industrial Central Business District, the property offers strong functionality and strategic access for industrial operators.

ACQUISITION: Hyde Park Commercial acquired two industrial assets in San Antonio, TX: a 9,300-square-foot service facility on 6.4 acres at 2023 FM 1516 in Northeast San Antonio and a 22,000-square-foot single-tenant industrial property at 15501 Capital Port Drive in Northwest San Antonio. Both assets support the firm’s strategy of targeting functional, service-oriented industrial real estate with strong yard capacity and durable cash flow. The acquisitions further expand Hyde Park’s footprint along key Texas logistics corridors within a high-growth San Antonio market.

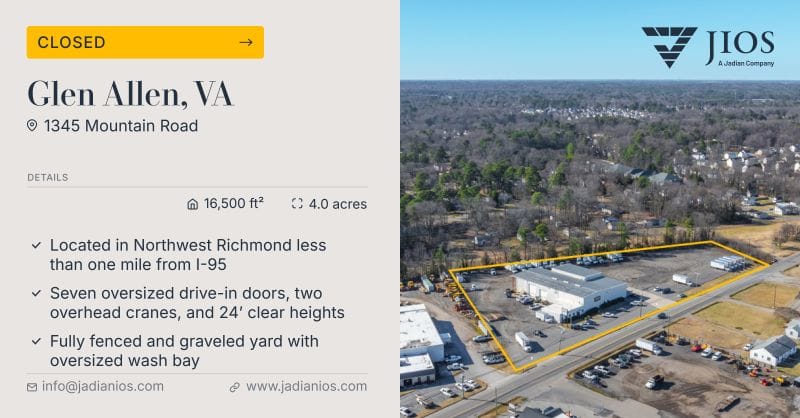

ACQUISITION: Jadian IOS acquired a 4.0-acre industrial service facility at 1345 Mountain Road in Glen Allen, VA. The 16,500-square-foot property is located in the Northwest Richmond submarket less than one mile from I-95 and features seven oversized drive-in doors, 24-foot clear heights, and a fully fenced, graveled yard with an oversized wash bay. The acquisition adds a highly functional IOS asset in a prime infill location with strong regional access.

CLOSED LEASES

Leased

LEASED: A 5.2-acre Industrial Outdoor Storage (IOS) site at 10451 Colonel Court in Manassas, VA has been leased in Prince William County. The property is zoned I-2 Heavy Industrial, supporting outdoor storage and related industrial uses. Colliers represented the landlord, Realterm, in the transaction, with JLL’s John Dettler representing the tenant.

ON THE MARKET

For Sale / For Lease Listings

FOR SALE OR LEASE: 6624 Quad Ave. in Baltimore, MD offers approximately 15,000 square feet across two recently renovated industrial buildings on 0.991 acres, available for lease either separately or together. The property features drive-in and dock loading, I-2 (Heavy Industrial) zoning, and a functional layout suited for a range of industrial users. Located in East Baltimore City with close proximity to I-95 and the Port of Baltimore, the site provides strong access to major transportation corridors and port infrastructure. Asking price is $4M for a sale. Reach out to Jim Chivers and Will McCullough for more info.

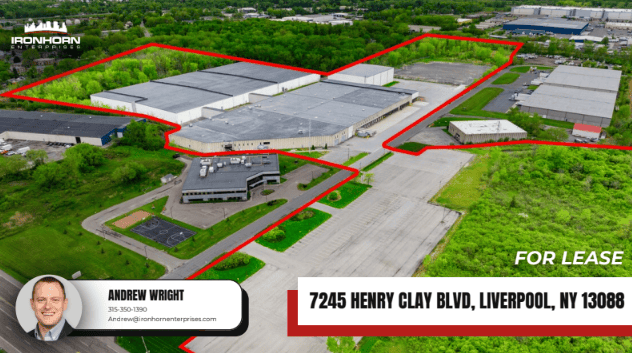

FOR LEASE: On ±58 acres just North of Syracuse, this ±602,807 SF industrial distribution/warehouse facility features 24–50’ clear heights, 120 trailer spaces, and outdoor storage with a total of 620 spaces. With direct access to I-90 and I-81, the property is strategically located near Amazon’s new 3.8M SF fulfillment center and less than five miles from Micron’s $100B White Pine Commerce Park project. See more listing details here.

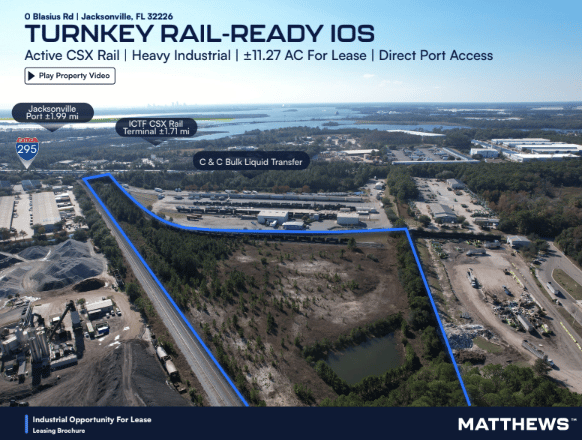

FOR LEASE: The site sits on Blasius Road directly along the CSX main line and includes two active on-site rail spurs totaling roughly 1,500 linear feet, with nightly switching already in place. Spanning approximately 11 acres and zoned Heavy Industrial (IH), the stabilized open yard is suited for transload, bulk materials, manufacturing, and import/export users, with lease terms up to 30 years at $0.85–$0.95 PSF NNN. Its location near JAXPORT, I-295, CSX intermodal facilities, and Jacksonville International Airport offers rare, immediate access to rail, truck, and port infrastructure. Reach out to Mike Salik for more info and see aerial footage here.

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,200+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.