YardDogs -

In today’s email:

Transactions: Acquisitions in FL (2), NC, a Portfolio Acquisition, and more.. Lease signed in CA.

On The Market: 4 IOS Listings

Recs: Transformation in Rialto

Have active IOS listings? Send to [email protected]

CLOSED TRANSACTIONS

Acquisitions / Dispositions

ACQUISITION: Brian Schwan completed the $6 million sale of a 40,139 SF industrial property on 13.84 acres featuring open-air canopies and dedicated rail access, highlighting continued demand for large-scale IOS assets along Florida’s Treasure Coast.

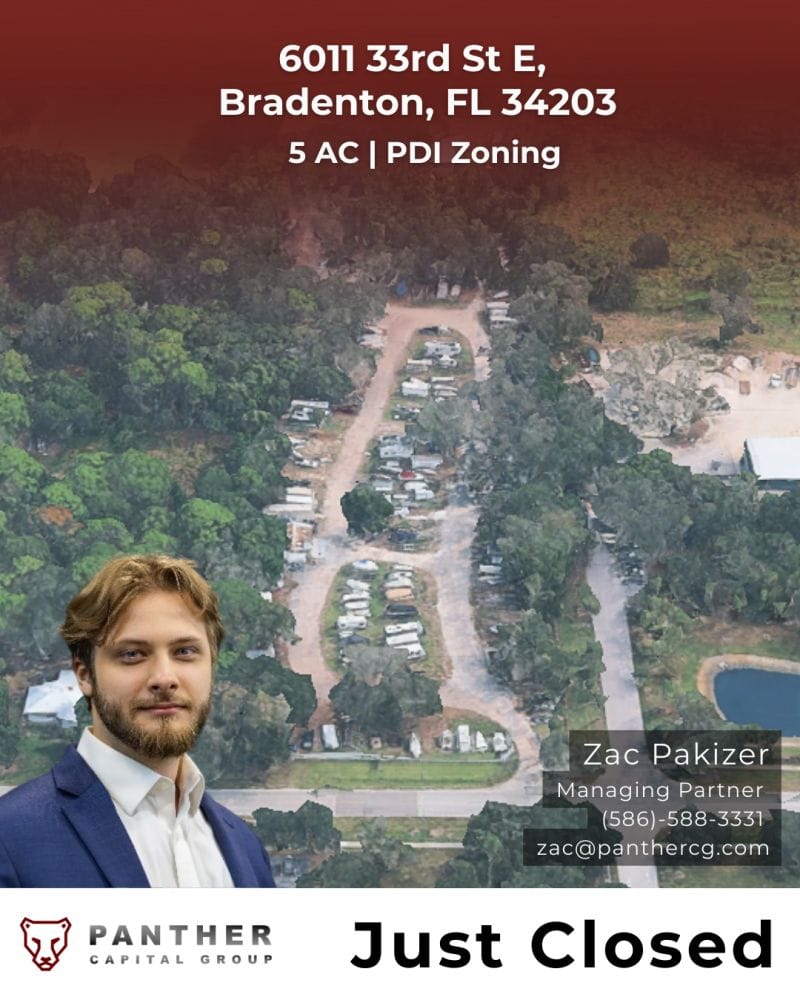

ACQUISITION: Zachary Pakizer of Panther Capital Group led the sale of a 5-acre PDI-zoned industrial outdoor storage site at 6011 33rd St E, offering flexible yard functionality in the growing Bradenton, FL market.

ACQUISITION: Alterra IOS continues to expand its national industrial outdoor storage platform with a recent 10-property acquisition totaling approximately 45 usable acres, 455 drive-in doors, and more than 238,000 square feet of warehouse space. The portfolio adds scale in key transportation corridors, positioning Alterra to meet sustained demand from transportation, equipment, and contractor users.

ACQUISITION: BlueRock has launched a $60 million industrial DST offering across five properties in four states, targeting institutional investors with exposure to essential logistics infrastructure. The portfolio’s positioning in core markets underscores continued confidence in industrial real estate fundamentals — including outsized growth in outdoor storage demand tied to transportation, construction, and equipment users.

ACQUISITION: Equus Capital Partners purchased a 579,236-square-foot industrial complex in Butner, North Carolina for $46.8 million, reinforcing investor appetite for strategically located logistics assets near the Research Triangle. Given strong activity across both enclosed warehouse space and adjacent IOS nodes in the region, this acquisition reflects the broader strength of industrial markets that support yard, equipment, and container storage users.

LEASES SIGNED

Recently Leased Properties

LEASE SIGNED: Brand Safeway has signed a 120-month lease at 805 W. Rialto Avenue in Rialto, CA, a 5.18-acre industrial outdoor storage (IOS) site owned by Stockbridge. The lease commenced at $0.28/LSF NNN with $0.08/SF in operating expenses, structured with no free rent and annual rent growth stepping to $0.33/LSF in Year 2 and $0.38/LSF in Year 3, followed by 4% annual increases. Gus Andros, SIOR represented the tenant, while Juan Gutierrez, Shy Assar, Ian Ozimec, CCIM, and Braden Sprenger represented the landlord.

ON THE MARKET

For Sale / For Lease Listings

FOR SALE: This anchored industrial portfolio in Casper, Wyoming spans 39.05 total acres and 94,030 SF across multiple properties, offered at a total price of $13,063,500. The offering includes four leased assets at an 8.25% cap rate, two vacant value-add buildings, and 20.05 acres of additional land for development within a long-standing industrial park. Anchored by GMS and Centurion affiliates, the portfolio features functional industrial buildings with outdoor storage, crane-served facilities, and direct access to I-25 in Wyoming’s primary energy and logistics hub. Reach out to Mark Williams for more info.

FOR LEASE: 6110 Chippewa Drive in Dallas, TX is a 2.3-acre industrial outdoor storage (IOS) property improved with a 7,082-square-foot service facility, including approximately 600 SF of office. The site features a stabilized yard with concrete and asphalt millings, three 14’ grade-level overhead doors, 14’ clear height, and a drive-through bay with wash bay (sand pit). The property is equipped with a diesel fuel tank, oil tank, and air and oil lines, and offers three points of ingress/egress for efficient truck circulation. Fully fenced and gated, the asset supports equipment storage, fleet operations, and industrial service users in a supply-constrained West Dallas infill submarket. Lease rate is $24,500 per month NNN. Contact Martin Grossman and David Guinn for more information or to schedule a tour.

FOR SALE OR LEASE: 3770 Joliet Street in Denver, CO is a 24,837 SF industrial building situated on 4.25 acres and offered for sale or lease. The property features approximately 2.6 acres of fenced and paved yard, 16’ clear height, heavy 1,600 amp / 480 volt power, one dock door, and two drive-in doors. With I-B zoning, direct access to I-70, and a Union Pacific rail spur on-site, the asset offers a highly functional industrial service or outdoor storage opportunity in a prime infill Denver location. Reach out to James McGill and Chris Schultz for more information.

FOR SALE OR LEASE: 845 S Jason Street in Denver, CO is a 28,863 SF industrial facility on 4.52 acres offered for sale or lease. The property includes approximately 2.5 acres of yard, 14’–20’ clear height, 2,000 amps of 480-volt 3-phase power, and four drive-in doors across two buildings. With I-MX-3 zoning, rail service potential, and strong access to Santa Fe, I-25, and C-470, the asset presents a highly functional infill industrial outdoor storage or service opportunity. Reach out to James McGill and Chris Schultz for more information.

RECS

Transformation

Transformation in Rialto: Donlon Builders served as General Contractor on a 3.5-acre IOS development, converting underutilized land into a fully improved container storage and truck parking site in coordination with Stonemont’s vision and entitlement strategy.

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,200+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.