YardDogs -

In today’s email:

Transactions: Brookfield to buy Peakstone Realty Trust. Acquisitions in FL, RI, MD, and TX. Financing in GA and SC. Plus Leases signed in NE, WI, OH, and FL!

On the Market: 4 listings

Recs: Check out CBRE’s 2026 North America Investor Intentions Survey

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

CLOSED TRANSACTIONS

Acquisitions / Dispositions

ACQUISITION: Brookfield to buy Peakstone Realty Trust in $1.2 Billion Deal.

The purchase would expand Brookfield’s industrial real estate platform with an investment trust that owns and operates industrial outdoor storage.

ACQUISITION: 705 N 39th Street just closed in Fort Pierce, FL. The property features 7,500 SF industrial warehouse on 2.37 acres. The property was sold to an owner/user and highlights the strength of demand for industrial properties with 1–3 acres of land in this market. Conor Mackin of Commercial Real Estate LLC executed the transaction.

ACQUISITION: Alterra IOS announced the acquisition of 707 E Park Drive, Woonsocket, RI outside of Providence. The property features: 2.1 usable acres, 10,800 SF of building improvements. The site is proximate to I-295 and Route 99 and is the 3rd acquisition in the Providence MSA for Alterra IOS. Sean Christman for led this transaction for Alterra IOS and Matty Drouillard and Stephen Flynn of The Stubblebine Company helped get the deal closed.

ACQUISITION: Catalyst Investment Partners announced the closing of 240 S Kresson Street, located in Baltimore, MD. The Property features a 9,600 SF service facility with 8 drive-in doors on 2.1 fully paved and secured acres. Jim Chivers helped structure the transaction and Connor Brophy led the deal on the Catalyst team.

ACQUISITION: Zenith announced the closing of the second of two Texas sites leased to FleetPride. Both properties feature recently completed, state-of-the-art maintenance bays with 25-foot clear heights and oversized drive-in doors. Wyatt Huff and Hunter Stockard helped bring this transaction to the finish line. Reach out to Peter Cannon on the Zenith team regarding any future acquisition opportunities in Texas.

FINANCING: Realterm continues to build momentum across its credit platform, marked by the origination of a $43.5M loan for a fully leased, 10‑property IOS portfolio. With nine assets in Atlanta and one in Charleston, the portfolio offers ample access and connectivity to the surrounding metropolitan areas.

CLOSED LEASES

Leased

LEASED: 5280 Asset Recovery recently leased 1750 Mason Street! The property features 4,392 SF of industrial building and 1 acre of industrial outdoor storage in Omaha, NE. John Meyer & Hilke Meyer from NAINP Dodge helped complete the lease!

LEASED: Luke Fehrenbach and Richard Reinders III of Ogden & Company, Inc., on behalf of their client, successfully negotiated and executed a lease with ITG Communications, LLC, a third-party telecommunications installation company, for an industrial flex property located at 3240 W. Elm Road in Franklin, Wisconsin. The transaction represents a full-circle deal for the Ogden team, as Luke previously assisted the client with the acquisition of the property for their business operations in 2025.

LEASED: SqFt Commercial leased 5700 Este Ave in Cincinnati, Ohio. This property is a 3.5-acre fenced and gated Industrial Outdoor Storage (IOS) site featuring 14,909 SF across four buildings. Located near I-75, this infill site offers access and functionality for logistics, fleet, and industrial users. If you’re looking to lease, buy/sell, or value IOS properties throughout Greater Cincinnati & Northern Kentucky, reach out to the SqFt Commercial team.

LEASED: Criterion Group shared that Solo Depot Container Facility leased 9501 NW 106th St, Medley, FL. Wayne Ramoski, SIOR, Ivanna Leitner and the Cushman & Wakefield team helped with the lease.

ON THE MARKET

For Sale / For Lease Listings

FOR LEASE: ±14.75 acres of industrial outdoor storage are available for lease at 102 W Elms Rd in Killeen, TX, offering flexible yard configurations suitable for equipment, vehicle, and material storage. The site features a build-to-suit opportunity, allowing ownership to deliver custom improvements tailored to tenant operational needs. Strategically located minutes from Fort Hood, the property benefits from strong regional demand driven by military, logistics, construction, and service users. Reach out to Stan Nowak, Andrew Alizzi, and Colten Courtney for more info.

FOR LEASE: 6100 Federal Blvd offers a truly hard-to-find infill IOS opportunity with over 10 acres of fully fenced and gated outdoor storage in a central location. The site is improved with a 10,400 SF warehouse, on-site truck scale, and zoning that allows IOS as-of-right, making it ideal for fleet, logistics, and outdoor storage users. A high-utility, secure IOS asset combining scale, infrastructure, and location rarely available in today’s market. Check out the LoopNet listing here.

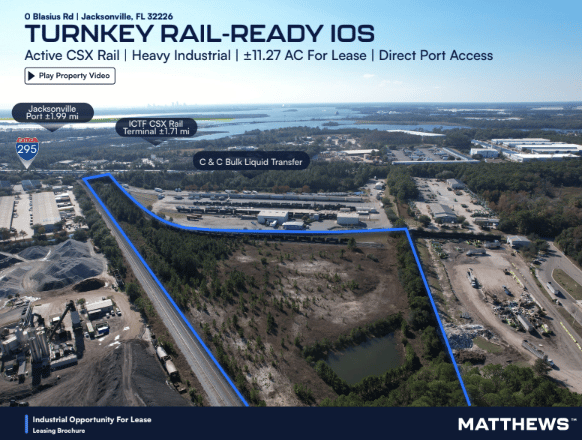

FOR LEASE: The site sits on Blasius Road directly along the CSX main line and includes two active on-site rail spurs totaling roughly 1,500 linear feet, with nightly switching already in place. Spanning approximately 11 acres and zoned Heavy Industrial (IH), the stabilized open yard is suited for transload, bulk materials, manufacturing, and import/export users, with lease terms up to 30 years at $0.85–$0.95 PSF NNN. Its location near JAXPORT, I-295, CSX intermodal facilities, and Jacksonville International Airport offers rare, immediate access to rail, truck, and port infrastructure. Reach out to Mike Salik for more info and see aerial footage here.

FOR LEASE: 40,000 SF available across two buildings on a 5.54-acre site in Lewisville, TX, featuring a fully stabilized and fenced yard with prime frontage on Business 121. The property offers six grade-level doors, approximately 4,500 SF of office/showroom space, and flexible functionality for yard-intensive users. Strategically located in the North DFW corridor, the site provides excellent access to regional highways and population centers. Reach out to Thomas Mercer for more info!

RECS

Recs

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,200+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.