YardDogs -

In today’s email:

Transactions: Open Industrial & Heitman Recap. Acquisitions in NC, TX, MD, MO, FL, OR. Lease signed in MD

On the Market: 2 listings + WANTED: Environmentally Challenged IOS For Sale

Recs: Before and After Transformation

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

CLOSED TRANSACTIONS

Acquisitions / Dispositions

RECAP: Open Industrial and Heitman LLC announced the formation of a new partnership to recapitalize a 25-asset industrial outdoor storage portfolio. The portfolio includes mission-critical sites in infill submarkets near major transportation nodes and population centers across Washington, D.C., Baltimore, Richmond, and Raleigh, supporting last-mile logistics, equipment rental, construction services, and other essential operations.

“This partnership brings together a best-in-class specialist operator and a globally respected institutional investor at a moment when IOS is evolving into a mainstream asset class,” said Brian Di Salvo.

Congrats to all involved!

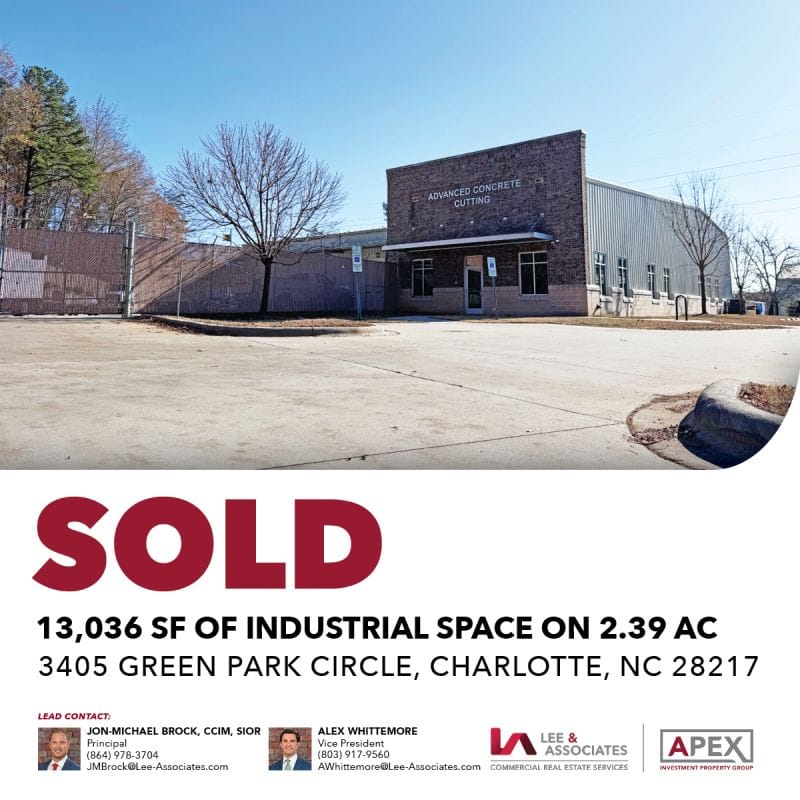

ACQUISITION: An IOS property at 3405 Green Park Circle in Charlotte, North Carolina has officially sold, totaling 13,036 SF on 2.39 acres. The transaction closed smoothly between repeat buyer and seller, highlighting strong relationships and trust on both sides. The deal was executed by the team at APEX Investment Property Group and Lee & Associates.

ACQUISITION: CanTex Capital acquired 4233 S Walton Walker Blvd in Dallas, Texas, a 6,500 SF industrial property situated on 2.71 acres. The site offers strong frontage and visibility along Loop 12 with quick access to Hwy 67, I-20, and Hwy 408, making it well positioned for IOS uses.

ACQUISITION: 4801 Stamp Road in Temple Hills, Maryland has sold, featuring an industrial outdoor storage site with approximately 6,000 SF of warehouse space on 1.76 acres. The property is zoned IE-4 and offers four drive-ins, paved and fenced yard space, and strong access inside the Capital Beltway. Matthew Antonis and Joseph Friend represented the seller and sourced the buyer.

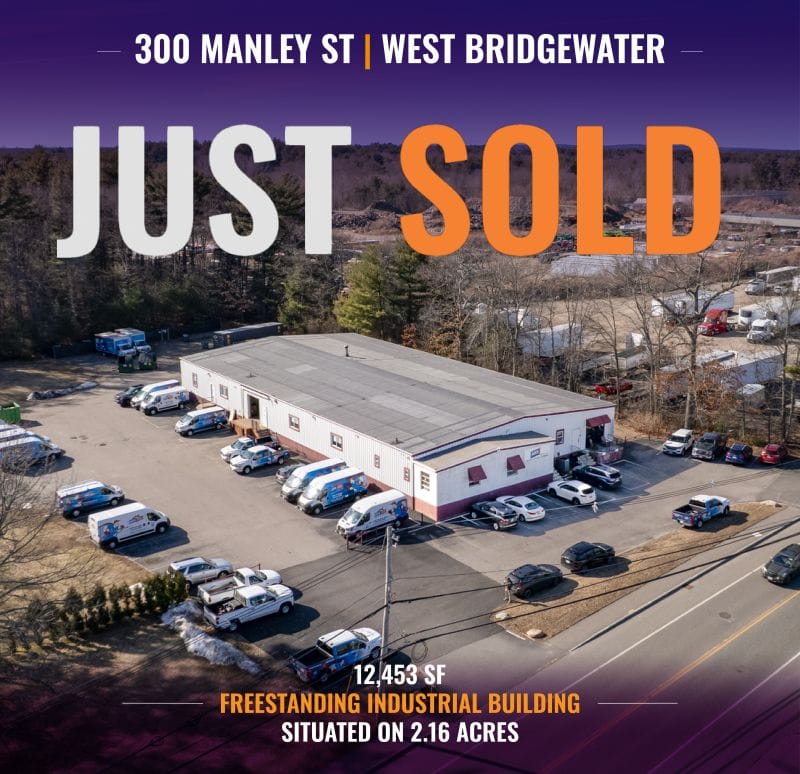

ACQUISITION: 300 Manley Street in West Bridgewater has sold, featuring a 12,453 SF freestanding industrial building on 2.16 acres. The property offers clear-span construction, loading and parking, a fenced and secure contractor-style yard, and recent upgrades including a new roof in 2024 and septic system in 2017. The transaction was guided to a successful close by David Ellis, SIOR.

ACQUISITION: Timber Hill acquired a newly constructed, fully leased industrial outdoor storage facility at 7300 E. 63rd Trafficway in Kansas City, Missouri. The property features 35.5 net usable acres, excellent frontage along I-435, and modern design tailored for IOS operations. The stabilized asset provides immediate cash flow and reinforces Timber Hill’s long-term strategy in high-quality outdoor storage investments.

ACQUISITION: An IOS deal closed in Tampa’s East Tampa submarket, featuring a 14,500 SF cross-dock truck terminal with approximately 3.5 acres of outdoor storage. The site benefits from close proximity to major highways, CSX rail yard, the Port of Tampa, and downtown logistics corridors.

ACQUISITION: Alterra IOS acquired 13000 Whitaker Way in Portland, Oregon, featuring 10.0 usable acres with 37,930 SF of building improvements. The site is well located near I-205 and I-84 and in close proximity to Portland International Airport, supporting efficient regional and national distribution. This marks Alterra’s eighth acquisition in the Portland MSA, reinforcing its growing presence in the market.

LEASES SIGNED

Recently Leased Properties

LEASED: 7675 Canton Center Drive in Baltimore, Maryland has been successfully leased, totaling 18,932 square feet of industrial space. The deal was executed in just five business days, highlighting strong demand and a highly efficient transaction process. Congrats to Brian Siegel, Drew Miles, Jason Sullivan, and the Catalyst Investment Partners team for a fast and well-coordinated close.

IOS WANTED

WANTED: Environmentally Challenged IOS For Sale

Will Consider Anywhere, USA – Open to Sites Nationwide with Preference in Logistically Significant Markets with Functional Buildings

ON THE MARKET

For Sale / For Lease Listings

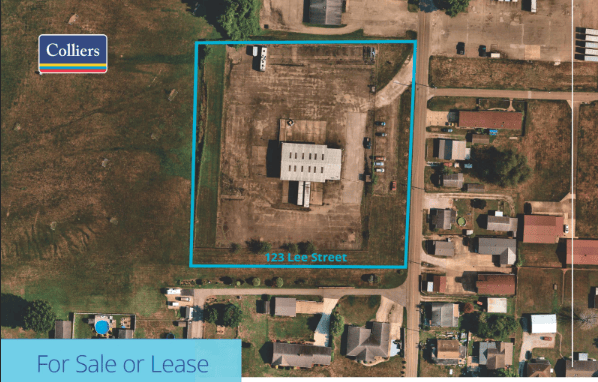

FOR SALE OR LEASE: 123 Lee Street in Belpre, Ohio is a versatile cross-dock warehouse with an IOS lay-down yard, featuring a 4,500 SF building on 3.161 acres with strong truck access and multiple dock-high doors. The property offers nearly 1.9 paved acres, partial fencing, city utilities, and zoning that supports truck terminal and contractor equipment storage uses. Located near SR-7, US-50, and I-77, the site provides efficient regional connectivity and access to a large Mid-Atlantic and Midwest population base. Reach out to Fred Kolb for more info.

FOR LEASE: 725 Red River Rd | Rock Hill, SC offers a compelling Industrial Outdoor Storage (IOS) lease opportunity with a 5,600 SF light-industrial building on a rare 15-acre LI-zoned site. The building features 16’ clear height and four 14’ drive-in doors, supporting efficient industrial and service operations. The expansive acreage allows for outdoor storage, fleet parking, and future expansion, with a TI allowance available for customization. Located in a highly accessible Rock Hill industrial corridor with quick access to major highways and the Charlotte metro, this property delivers scalability, flexibility, and strong regional connectivity.

To view more about this property please visit the LoopNet Listing

See more available properties on LoopNet

RECS

Before and After Transformation

Highlighting a before and after transformation shared by Derick Perkins

Before:

After:

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,200+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.