YardDogs -

In today’s email:

Transactions: CO (2), TX, FL, AZ + a Financing. Lease signed in FL.

On the Market: 4 listings

Recs: U.S. Industrial RE Market Outlook

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

CLOSED TRANSACTIONS

Acquisitions / Dispositions

ACQUISITION: An 8,000 SF industrial building on a 4.06-acre industrial outdoor storage site in Durango, CO was sold. The property features a yard-heavy layout well suited for building supply, construction, and service users in a supply-constrained mountain market. Congrats to Sharon Monagas at Doherty Houston Industrial Group for leading the transaction and to Builders FirstSource on the acquisition.

ACQUISITION: Dalfen acquired 10701 Todd Street in Houston, TX — a 23,508 SF industrial building on a 2.68-acre industrial outdoor storage site. The property is strategically positioned near I-290, I-10, and I-610, offering strong connectivity for yard-intensive users in the Houston market. Congrats to John Lettieri, CFA and Kyle Weldon for their work on the acquisition.

FINANCING: Alterra IOS secured a $100 million fund-level revolving credit facility from BMO to support the continued expansion of its industrial outdoor storage platform. The facility is designed to move in step with Alterra’s high-volume acquisition pipeline and will initially be backed by 27 IOS properties across 17 states. The financing builds on more than $1.6 billion of institutional capital Alterra has raised across its IOS ventures as it continues to scale nationally.

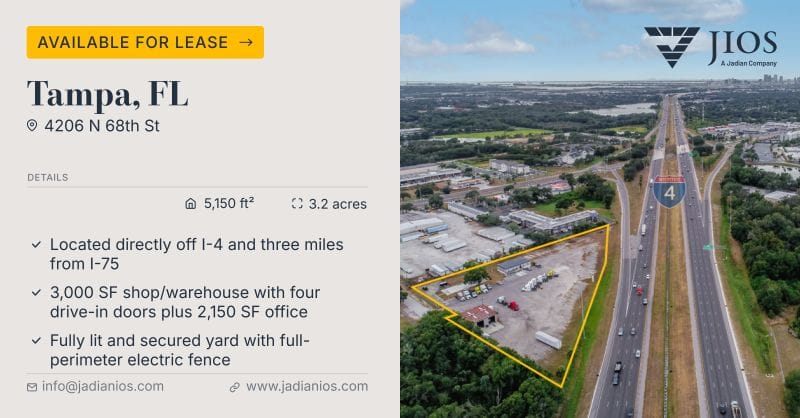

ACQUISITION: Jadian IOS acquired a 3.2-acre industrial service facility in Tampa, FL at 4206 N 68th Street. The property is located directly off I-4 near I-75 and features a ±5,150 SF building, secured yard, and strong access for service and yard-intensive users.

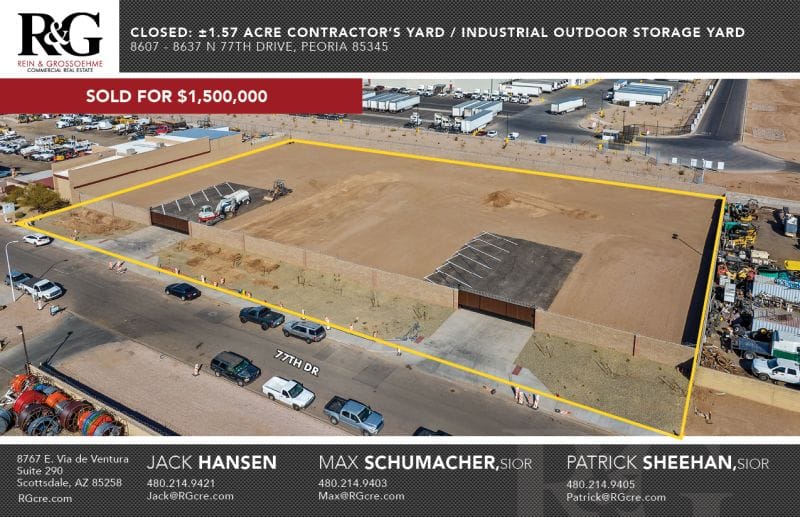

ACQUISITION: A 1.57-acre contractor’s yard in Peoria, AZ was sold for $1,500,000. Congrats to Jack Hansen, Max Schumacher, SIOR, and Patrick Sheehan, SIOR for representing the buyer and seller on the transaction.

ACQUISITION: Steel Peak acquired 4600 Monaco Street in Denver, CO for $3.27 million — a 16,858 SF industrial building on a 2.07-acre industrial outdoor storage site. The property offers heavy industrial zoning, over one acre of usable yard, grade-level loading, and direct access to I-70 in a supply-constrained infill Denver submarket. Congrats to Mike Viehmann, SIOR at Newmark for representing the buyer, and Doug Viseur and Nic Carter at CBRE for representing the seller.

LEASES SIGNED

Recently Leased Properties

LEASED: a ±15,000 SF industrial building on ±1.2 acres of industrial outdoor storage in Lakeland, FL. The site is well-positioned for service, construction, and distribution users needing yard space with building support. Another example of small-bay IOS getting absorbed quickly in Central Florida. Congrats to Robbie and Devin on getting this leased!

ON THE MARKET

For Sale / For Lease Listings

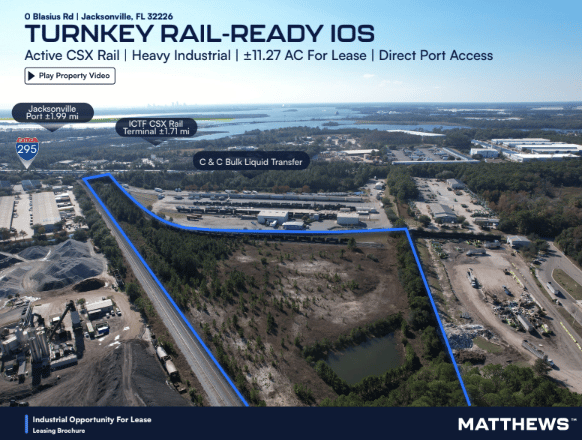

FOR LEASE: The site sits on Blasius Road directly along the CSX main line and includes two active on-site rail spurs totaling roughly 1,500 linear feet, with nightly switching already in place. Spanning approximately 11 acres and zoned Heavy Industrial (IH), the stabilized open yard is suited for transload, bulk materials, manufacturing, and import/export users, with lease terms up to 30 years at $0.85–$0.95 PSF NNN. Its location near JAXPORT, I-295, CSX intermodal facilities, and Jacksonville International Airport offers rare, immediate access to rail, truck, and port infrastructure. Reach out to Mike Salik for more info and see aerial footage here.

FOR LEASE: This 4.5-acre industrial outdoor storage site in Selma, TX features a ±4,000 SF warehouse and ±2,556 SF two-story office with direct access to I-35 and the broader San Antonio industrial corridor. The property offers concrete truck courts, dock-high and grade-level loading, and extensive trailer and equipment parking across a fully paved and fenced yard. Built in 1990, the site is well-suited for logistics, fleet, construction, or service-oriented users needing infill IOS with office support. Reach out to Stan Nowak, Andrew Alizzi, and Colten Courtney for more info.

FOR SALE: Opportunity to acquire a 1.88-acre Industrial Outdoor Storage (IOS) property with a 5,600 SF maintenance building and 1,100 SF office in Commerce City. Zoned I-2 (Heavy Outside Storage), the site features four oversized drive-in doors, perimeter lighting, vehicle plug-ins, radiant heat, hydraulic lifts, air lines, floor drains, and a wash station—ideal for fleet and heavy-equipment users. Centrally located with quick access to I-70, I-270, I-25, Denver International Airport, and Downtown Denver, this is a hard-to-find IOS asset in a supply-constrained submarket. Reach out to Matt Nora for more info.

FOR LEASE: 7800 S 206th Street in Kent, WA, featuring 15,000 SF of covered storage on 4.52 acres with excellent yard functionality. The site offers strong access and is available now for industrial outdoor storage and service-oriented users. Reach out to John Broom for more info.

RECS

Recs

U.S. Industrial RE Market Outlook from Cushman & Wakefield

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,200+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.