YardDogs -

In today’s email:

Transactions: Acquisitions in FL, MO, MI, KS, and NC. Lease signed in NJ and KY.

Financing/Credit: $115 million in portfolio financing and $100 million revolving credit facility closed!

WANTED: Environmentally Challenged IOS For Sale

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

CLOSED TRANSACTIONS

Acquisitions / Dispositions

ACQUISITION: Jason McCormick at Lober Real Estate recently facilitated the sale at 11805 State Road 54, Odessa, FL for $5,650,000. The property features 27,300 SF on 5.25 acres. This deal took over two years to develop, following relationship and trust-building between Jason and the seller. For deal specifics or to talk deals in Central/West Florida, reach out to Jason.

ACQUISITION: COARE Industrial acquired 7235 Gardner Street in Winter Park, Florida. The 1.4 acre site features a graveled yard and two existing structures totaling 3,245 SF. Strategically zoned “IND-1/IND-5” within Unincorporated Orange County, the property permits all forms of outdoor storage by-right. COARE pre-leased the asset during the due diligence period to a prominent regional horticultural services firm.

Rich DeGirolamo and Santiago Acevedo helped arrange this transaction. The COARE team was led by Stephen Barry and Hansel Rodriguez. For all investment opportunities, please contact Stephen at [email protected].

ACQUISITION: The Bauman Moffitt Team led by Tivon Moffit and Peter Bauman at IPA announced the successful closing of two STNL warehouse and industrial outdoor storage facilities leased to BlueLinx in the Kansas City and St. Louis Metros. These infill assets totaled just under 45 acres and offered scale, functionality, and long-term income durability, which drove strong investor interest and a successful outcome for their client.

ACQUISITION: Torch Capital announced they closed on their first IOS transaction — a 27-acre truck yard in Monroe County, MI. Dan Stewart’s team at Torch Capital and SVN Stewart Commercial Group are actively looking to connect with owners, operators, and investors who are also focused on IOS.

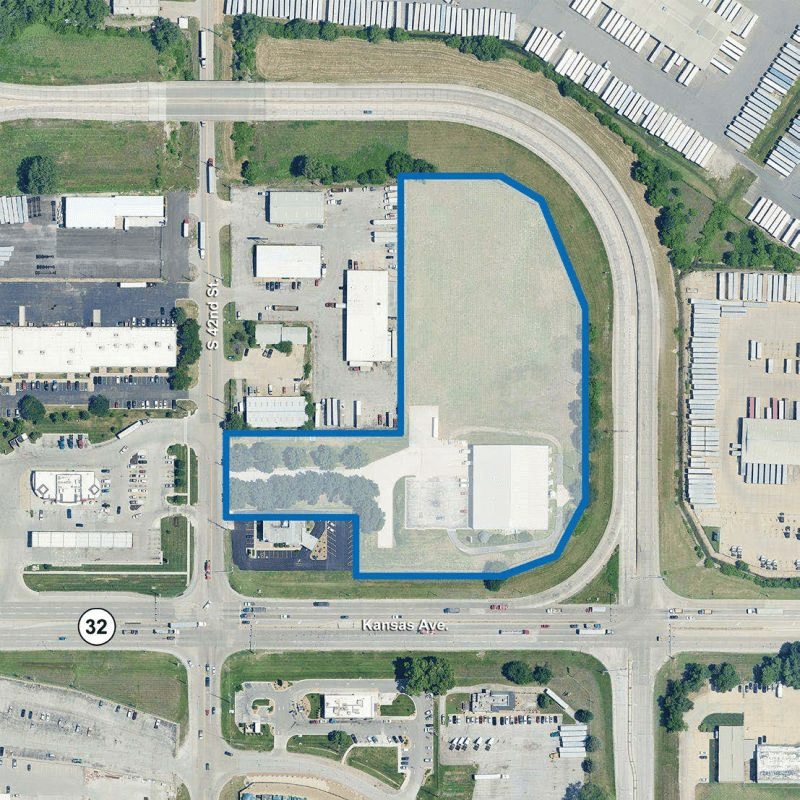

ACQUISITION: Base Industrial announced their latest acquisition at 417 S. 42nd Street in Kansas City, KS. They acquired the property from an owner-user who vacated at year-end and successfully executed a lease with a new tenant during due diligence.

John Faur, CCIM, John Hassler, and Mark Long at Newmark facilitated the acquisition and lease. Reach out to Evan Welsh for more information.

ACQUISITION: Open Industrial recently acquired a 2.2 AC property located at 3601 Hillsborough Rd, Durham, NC. The property includes roughly 23,000 SF comprised of warehouse and office space with fenced laydown yard. The site is strategically positioned next to the I-85 on ramp, providing immediate access to the greater Raleigh/Durham MSA. The site was acquired from an owner/user and features a mix of Industrial Light and Industrial zoning, which allows for a broad range of industrial, outdoor storage, and retail uses. Gary W. Kramling and Seth Jernigan, CCIM represented the Seller, and the Open Industrial deal team included Elmo Alexander, Chad Pitts, and Matt Potolicchio. For leasing inquiries, please contact Justin Booth and Austin Jackson with JLL.

LEASES SIGNED

Recently Leased Properties

ACQUISITION: The Metz Industrial Group (MIG) has completed the lease of the entire industrial outdoor storage property located at 869–871 Julia Street in Elizabeth, NJ, on behalf of Northeastern Lumber Building Supply. The 1.6-acre IOS site includes a 4,225 SF maintenance facility, and will support Northeastern Lumber Building Supply’s continued operations and growth within the Northern New Jersey market.

Jordan Metz, Benito Abbate, and James Friel of the Metz Industrial Group represented the tenant in the transaction. The landlord, Elberon Development Group, was represented in-house with help from Terry Armstrong.

IOS WANTED

WANTED: Environmentally Challenged IOS For Sale

Will Consider Anywhere, USA – Open to Sites Nationwide with Preference in Logistically Significant Markets with Functional Buildings

FINANCING

Financing/Credit

FINANCING CLOSED: Justin Horowitz, Ben Knopf, Joshua Tropper, of Cooper-Horowitz worked with Open Industrial and Heitman to close $115,000,000 in IOS financing. This comes as Open Industrial and Heitman have formed a strategic joint venture to recapitalize a 25-property IOS portfolio and provide capital for new acquisitions.

CREDIT FACILITY CLOSED: Alterra IOS has closed a $100 million fund-level revolving credit facility from BMO. The facility is structured to complement Alterra’s acquisition pipeline and demonstrates BMO’s ability to provide flexible financing that supports the continued growth of the IOS sector.

RECS

Auto Dealership to Building Supply Facility

Example of an auto dealership transformed for IOS building-supply use. R.P. Lumber opened its 91st and newest location in Carlyle, IL. The family-owned, full-service home center and building materials retailer recently completed an extensive remodel of the former Wiegman Ford property at 1351 William Rd., bringing new life to the site.

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,200+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.