Market Monday: Portland, OR

Summary:

Market Overview: Portland’s population growth has moderated from pandemic-era highs but remains supported by a diversified economic base, a strong base of small and mid-sized operators, and continued public investment across the metro. Industrial vacancy remains tight in core infill submarkets, even as new supply delivers on the fringe. As the region evolves, limited infill land along the Willamette and Columbia corridors, fragmented zoning across municipalities, and entitlement complexity are expected to intensify competition for well-located IOS sites, reinforcing Portland’s role as a critical West Coast logistics and service hub.

The IOS Opportunity: Lease rates initiated between 2024 and 2025 generally range from approximately $6K to over $10K per acre per month, with average pricing clustering around the ~$8K range. Sites with favorable zoning, efficient layouts, and immediate access to I-5, I-205, or Highway 26 continue to command premiums.

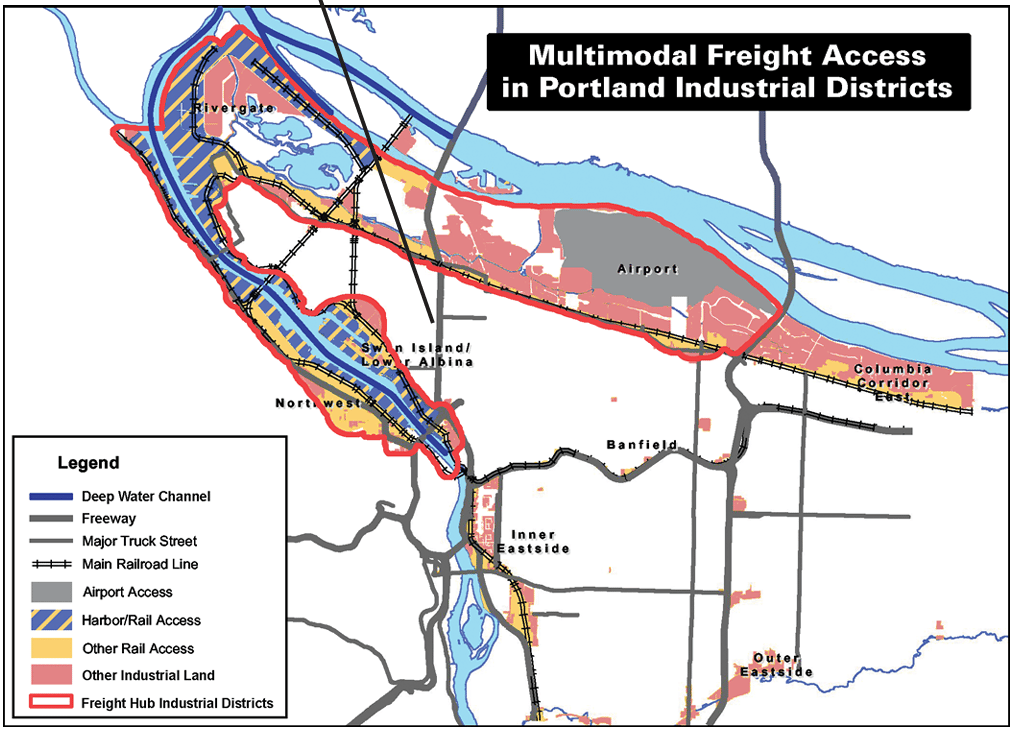

Market Fundamentals: Portland’s industrial ecosystem is anchored by extensive multimodal connectivity — I-5, I-205, Highway 26, regional rail networks, river access via the Willamette and Columbia Rivers, the Port of Portland, and proximity to PDX — supporting freight, construction, utilities, forestry products, recycling, and service-sector users that depend on outdoor storage. Ongoing public and private investment in port facilities, highway modernization, and intermodal infrastructure continues to reinforce long-term demand.

Local Brokers & Market Experts: Scroll to the bottom for a list of active IOS listings and experts shaping the Portland market — special thanks to Colliers and Capacity Commercial for participating!

Active Listings: See below for the latest Portland listings!

If you want to participate in a future Market Monday, email [email protected]

MARKET OVERVIEW

Portland

Portland’s population growth has moderated from pandemic-era highs but remains supported by a diversified economic base, a strong base of small and mid-sized operators, and continued public investment across the metro. Industrial vacancy has risen as new supply outpaces tenant demand in some quarters, even as deliveries continue and absorption remains uneven.1

Portland functions as a key logistics hub in the Pacific Northwest by combining interstates (I-5, I-205, I-84), major rail lines, river navigation on the Willamette and Columbia, a deep-water port, and a major international airport in one metro. This network supports freight moving between the Pacific Rim, the West Coast, and inland markets across Oregon, southwest Washington, Idaho, and Montana. The metro serves as a distribution and service base for cities like Seattle, Tacoma, Vancouver (WA), Salem, Eugene, Bend, and Spokane.

As the region evolves, limited infill land along the Willamette and Columbia corridors, fragmented zoning across municipalities, and entitlement complexity are expected to intensify competition for well-located IOS sites, reinforcing Portland’s role as a critical West Coast logistics and service hub.

Portland’s century-long investment in freight infrastructure has created an industrial network that would be nearly impossible to replicate elsewhere, giving the Harbor and Columbia Corridor districts a lasting advantage for industrial uses. As the Portland Industrial Districts Atlas notes, these areas have become core hubs for distribution and heavy manufacturing and are well positioned to benefit from Pacific Rim trade and the growing importance of flexible, multimodal logistics.2

IOS OVERVIEW

Portland IOS Opportunity

Portland is a structurally complex IOS market. Infill industrial land is limited, zoning for yard-intensive uses varies widely by city and county, and redevelopment pressure continues to reduce legacy IOS inventory.

Leasing activity across Portland’s IOS market has softened following a strong run through late 2023. Tom Knecht of Colliers notes that “we’re experiencing fairly soft demand at the moment, with overall leasing velocity down—mirroring the slowdown in warehouse activity.” Chris Kappes of Capacity Commercial echoes this trend, adding, “Tenant demand has softened in the Portland metro for IOS, following strong investor and tenant demand until late 2023.”

Despite softer conditions overall, demand remains most active among equipment rental providers, heavy equipment contractors, utilities, and service-based operators. Knecht notes that “the most active industry sectors in the Portland market right now are equipment rental providers and heavy equipment contractors… In contrast, trucking firms have been relatively quiet, as the logistics sector has remained sluggish in the post-COVID environment.”

While leasing has slowed, the investment market remains active. Knecht notes that “the sales side has still been active as institutional capital remains interested in the long-term viability of Portland’s IOS market… acquisition interest in Portland is still very high.”

Even with near-term softness, long-term IOS fundamentals in Portland remain intact. Durable demand from construction, utilities, equipment rental, environmental services, and fleet-based operators continues to support the sector, while zoning friction, environmental overlays, and redevelopment pressure constrain future supply. As a result, well-located, functional IOS sites with strong access, security, and operational layouts continue to outperform, even as less competitive assets face pricing and concession pressure.

FEATURED LISTINGS

Portland

Colliers

Please reach out to Tom Knecht for more information on the below.

5305 NE 115th Ave | For Lease

Industrial outdoor storage site along I-205 offering ±4.06 acres with a 5,600 SF shop building at 5305 NE 115th Avenue in Portland, featuring a large open yard with paved and gravel surfaces and excellent access to major regional highways, making it ideal for contractors, fleet operators, equipment users, or outdoor storage tenants seeking infill Portland exposure.

Capacity Commercial

Please reach out to Chris Kappes for more information on the below.

110 N Marine Drive | For Lease

Truck maintenance and outdoor storage facility for lease at 110 N Marine Drive in Portland, featuring ±44,647 SF across multiple shop buildings on an 18.39-acre lot with flexible divisibility. The site offers multiple access points, paved and fenced yard areas, small gravel storage zones, and infrastructure designed for fleet and service operations. Ideal for truck maintenance, fleet services, contractors, or outdoor storage users needing scale and strong access in an infill Portland location.

10103 NE Marx St. | For Lease

Industrial space for lease at 10103 NE Marx Street in Portland offering ±30,000 SF on 5.3 acres with a fully secured, hard-packed gravel yard. The site provides excellent visibility from I-205, access from NE 101st Avenue and NE Marx Street, and is ideally suited for trucking, auto-related users, contractors, or other industrial operations. Located 1.2 miles from I-205, 2 miles from I-84, and 5 minutes from PDX, with the ability to combine adjacent land for a total of 9.5 acres.

5605-5621 NE 105th Ave | For Lease

Prime industrial site for lease at 5605–5621 NE 105th Avenue in Portland offering ±2 acres with ±4.22 acres of yard and ±14,911 SF of warehouse space, featuring a flat, paved and gravel yard and excellent visibility from I-205 with two access points from NE 105th Avenue. The property is well suited for storage, trucking, auto-related users, or other industrial uses, and is ideally located 1.2 miles from I-205, 2 miles from I-84, and 5 minutes from Portland International Airport, with the ability to combine neighboring land for a total of 9.5 acres.

LOCAL EXPERTS

Local Brokers & Market Experts

Big thanks to all participants who helped shape this week’s Market Monday in Portland. If you’re looking to buy, sell or lease in Portland, the people below are the ones to call!

Colliers

Tom Knecht, SIOR

Vice President

M: 503-780-6449

E: [email protected]

Capacity Commercial

Scott Kappes

P: 503-816-4201

E: [email protected]

Kenny Houser

P: 503-385-6080

E: [email protected]

Chris Kappes

P: 503-517-7127

E: [email protected]

SOURCES & REFERENCES

IOS Resources

Check Out Our Free IOS Underwriting Model Tool

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.