Market Monday: Salt Lake City, UT

Summary:

Market Overview: Salt Lake City continues to benefit from strong population growth, above-average job formation, and its position as a key inland logistics and service hub for the Mountain West. Industrial demand remains durable across the Wasatch Front, driven by construction, building materials, fleet services, and regional distribution users serving Utah, Idaho, Wyoming, and Nevada.

The IOS Opportunity: Lease rates initiated in 2025 generally range from approximately $3K to $10K per acre per month, with an average of $5-6k per acre per month. Over the past two years, price per acre range from $700k-$1.5M and average around $1.3M. While new industrial supply has delivered in outlying submarkets, vacancy for infill, yard-oriented sites remains tight, particularly along established corridors near I-15 and I-80. Limited flat infill land and increasing zoning scrutiny are reinforcing competition for functional IOS assets.

Market Fundamentals: The market is anchored by exceptional connectivity, including I-15 (north–south spine of the Wasatch Front), I-80 (east–west interstate linking California to the Rockies), and proximity to Salt Lake City International Airport and Union Pacific rail infrastructure. IOS activity is concentrated in submarkets such as North Salt Lake, South Salt Lake, West Valley City, and areas west of downtown with direct interstate access. These locations allow operators to efficiently serve dense population centers while maintaining reach across the broader Mountain West.

Local Brokers & Market Experts: Scroll to the bottom for a list of active IOS listings and experts shaping the Salt Lake City market — special thanks to the Newmark Team for participating!

Active Listings: See below for the latest Salt Lake City listings!

If you want to participate in a future Market Monday, email [email protected]

MARKET OVERVIEW

Salt Lake City

Salt Lake City’s position as a logistics hub is rooted in its robust, multimodal infrastructure network. Historically known as “The Crossroads of the West,” the city sits at the convergence of three major interstate highways—I-15, I-80, and I-84—providing direct connectivity across the western United States.1 Utah’s advanced road network provides access to approximately 80 million consumers within an 18-hour drive, and roughly 25% of the continental U.S. can be reached within a single day by truck. On the rail side, Salt Lake City benefits from dual Class I railroad service through both Union Pacific and BNSF Railway.2 In July 2025, BNSF opened a new 43-acre intermodal facility in partnership with Patriot Rail and the Utah Inland Port Authority (UIPA), further strengthening supply chain connections between the West Coast and the Intermountain West.3

Recent industrial momentum continues to reinforce IOS demand. Despite moderating leasing activity, the Salt Lake City industrial market recorded positive net absorption in 2025, with non-bulk and specialized product types remaining significantly tighter than bulk distribution space. Industrial vacancy across non-bulk asset classes remains near historical lows, reflecting sustained occupier demand for functional, infill-oriented facilities.

As the region grows, competition for well-located IOS sites is increasing. Industrial development pressure, limited flat infill land along the Wasatch Front, and zoning friction across multiple municipalities are expected to intensify demand for functional IOS properties with strong access, circulation, and security characteristics.

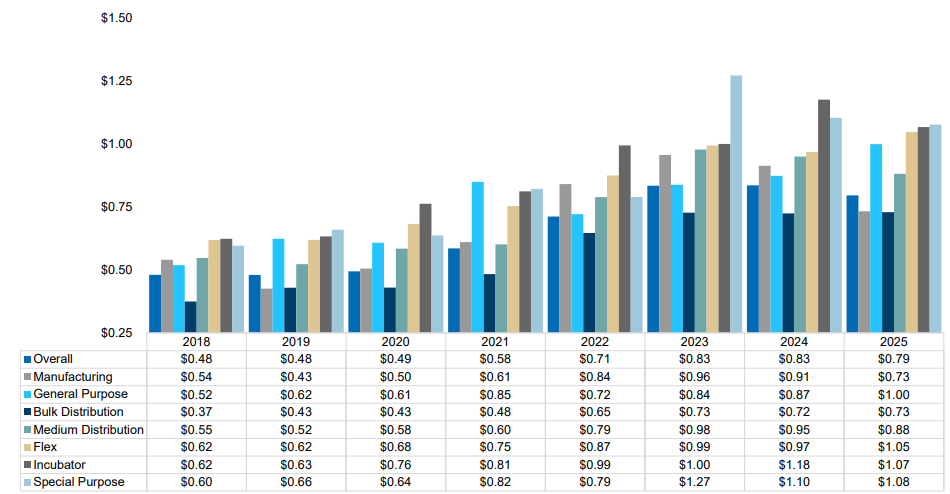

Rent performance in the Salt Lake City industrial market continues to diverge by product type. While achieved rents declined year over year due to increased landlord concessions in traditional industrial and bulk distribution assets, general-purpose, flex, and incubator properties continued to post rent growth, reflecting sustained demand for smaller, functional, and operationally flexible space. This trend underscores why well located IOS and yard oriented service sites, which often compete with flex and general purpose product, have remained resilient despite broader market recalibration.

IOS OVERVIEW

Salt Lake City IOS Opportunity

The Salt Lake City, Utah IOS market experienced sustained tenant and buyer demand throughout 2025, driven by limited availability of functional outdoor storage sites and steady industrial activity across the Wasatch Front.

Eli Priest of Newmark notes that “the Salt Lake City IOS market continues to see strong tenant and investor demand, driven by limited availability of functional outdoor storage sites and steady industrial activity across the Wasatch Front. Supported by I-15 and I-80 connectivity, proximity to Salt Lake City International Airport, Union Pacific rail infrastructure, and a rapidly growing population base, the region’s fundamentals continue to support long-term IOS demand.”

Priest adds that “one of the biggest challenges in the Salt Lake City IOS market is constrained supply, particularly for well-located infill yards that can accommodate immediate operational needs. Zoning inconsistency across municipalities, combined with increasing scrutiny of yard-heavy uses, has made it difficult to deliver new IOS product, leaving few functional options for tenants with specific layout, access, and circulation requirements.”

Long-term IOS fundamentals in Salt Lake City and along the Wasatch Front remain strong. Durable demand from construction, utilities, equipment rental, building materials, and fleet-based service operators continues to support the sector, while zoning friction, limited flat infill land, and development economics constrain future supply. As a result, well-located, functional IOS sites with clear zoning, strong access, and efficient operational layouts continue to outperform, even as less competitive assets face longer downtime and pricing pressure.

FEATURED LISTINGS

Salt Lake City

Newmark

Please reach out to Eli Priest for more information on the below.

7305 W 2100 S | For Lease

An industrial outdoor storage site is available for lease or build-to-suit at 7305 W 2100 S in Magna, UT, offering 4.76 acres with M-2 heavy manufacturing zoning. The site features secure fencing, lighting, utility access, and immediate connectivity to SR-201, I-80, I-215, and I-15, with a 10-minute drive to Salt Lake City International Airport. Asking rent is $5,500 per acre per month, positioning the property as a well-located infill IOS option.

4582 W Skyhawk Dr | For Lease

An approximately 2.5-acre industrial land site is available for lease at 4582 W Skyhawk Dr in West Jordan, UT, offering immediate access to I-15 and strong connectivity across the Salt Lake Valley. The property is located just 0.8 miles from South Regional Airport and approximately seven minutes from I-215, making it well suited for yard-oriented service and fleet users. The site provides a functional infill option for operators seeking proximity to major transportation corridors and regional population centers.

LOCAL EXPERTS

Local Brokers & Market Experts

Big thanks to all participants who helped shape this week’s Market Monday in Salt Lake City. If you’re looking to buy, sell or lease in Salt Lake City, the people below are the ones to call!

Newmark

Eli Priest

Senior Managing Director

Newmark

[email protected]

801.746.4746

Lucas M. Burbank

Executive Managing Director

Newmark

[email protected]

801.578.5522

Kelsie Akiyama

Senior Associate

Newmark

[email protected]

801.578.5504

Canyon Czapla

Brokerage Services Specialist

Newmark

[email protected]

801.578.5515

SOURCES & REFERENCES

IOS Resources

Check Out Our Free IOS Underwriting Model Tool

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.