YardDogs -

Miss any industrial outdoor storage (IOS) activity in November? We’ve got you covered with the biggest deals of the month.

In today’s email:

Top Transactions: This week we’re featuring some of the top transactions of November 2025. Let us know if you had others that should be on the podium!

IOS YARDDOGS TOP DEALS

November 2025

ACQUISITION: IronHorn is pleased to announce the acquisition of a 38,280 SF cross-dock facility at 6101 Lindsey Road in Little Rock, AR. Situated on 7.33 secure, fenced acres, the property offers 56 dock-high doors, four drive-ins, and 24' clear height - ideal for high-throughput operations. Its strategic location directly off I-440, with fast access to I-40, I-30, and the Port of Little Rock, positions users at the heart of a highly connected logistics network. With more than 25,000 trucks traveling I-40 daily and over 90 million consumers within a day’s drive, this site delivers exceptional regional reach. This acquisition underscores IronHorn’s commitment to expanding its industrial outdoor and logistics-focused portfolio in key transportation corridors.

ACQUISITION: Kenai Capital Advisors represented Bamboo Equity Partners in the sale of a two-asset industrial outdoor storage portfolio totaling 36,321 square feet across 6.45 acres in Denver, CO and Oklahoma City, OK. The properties include a 10,000-square-foot ISF in Denver and a 26,321-square-foot industrial building in Oklahoma City, each offering drive-in loading, outdoor storage, and strong regional connectivity. The buyer, a California-based private investor, acquired both assets through a publicly marketed process.

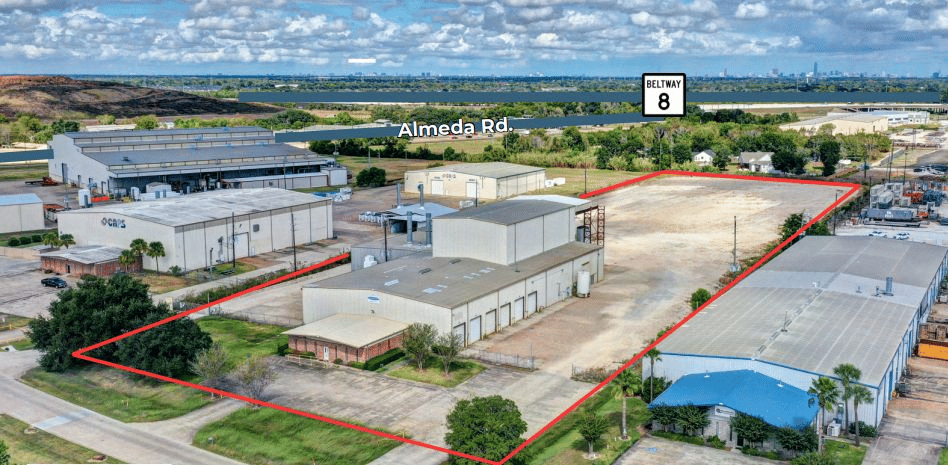

ACQUISITION: First Houston Properties closed the sale of a Class-A urban-core industrial property at 6287 Long Drive in Houston, TX. The deal was led by James Mashni with contributions from Jared Edelman and Patrick McBreen. The transaction reflects continued investor demand for high-quality industrial and IOS assets in Houston’s infill market.

ACQUISITION: Virtue Real Estate Partners closed the sale of a two-property IOS portfolio in Houston and Tulsa totaling 52,393 square feet on 14.71 acres. The fully leased assets were sold in an off-market transaction, with Virtue representing Alterra IOS.

ACQUISITION: Alex Whittemore and Jon-Michael Brock facilitated the sale of 7131 Bryhawke Circle in North Charleston, SC last week. The property includes a 15,041 SF building on 2.30 usable acres. The APEX Investment Property Group team also represented the buyer when they purchased it early 2024. Originally the site was for lease, but an off-market owner-user opportunity made more sense.

ACQUISITION: Greenspring Realty Partners (GRP) has acquired 7810 Professional Place in Tampa, FL, a 14,434 SF heavy industrial facility on 2.32 acres, featuring four drive-in doors and highly functional space for service-based industrial users. The property was fully leased prior to closing, reinforcing their proactive approach to sourcing and securing high-quality tenants ahead of acquisition. Congratulations to Nicki Berg and the Greenspring team!

ACQUISITION: Brennan Investment Group recently announced the acquisition of two IOS properties located at 505 W. Yager Lane in Austin and 55 Southbelt Industrial Drive in Houston. These acquisitions highlight Brennan’s strategic focus on high-demand, functional IOS assets across the Texas Triangle, where limited supply and strong tenant demand continue to drive growth. Managing Principal, Troy MacMane shared, “These acquisitions are a testament to our belief in the long-term fundamentals of the IOS sector in Texas.” The Brennan team also included Harrison Wright and William Saied.

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,100+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

🚀To advertise with IOS YardDogs (for lease / for sale listings, vendors),

email: [email protected]

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.