YardDogs -

Miss any industrial outdoor storage (IOS) activity in 2025? We’ve got you covered with the biggest deals of the year.

In today’s email:

Top Transactions: We’re featuring some of the top transactions of 2025. Let us know if you had others that should be on the podium!

IOS YARDDOGS TOP DEALS

2025

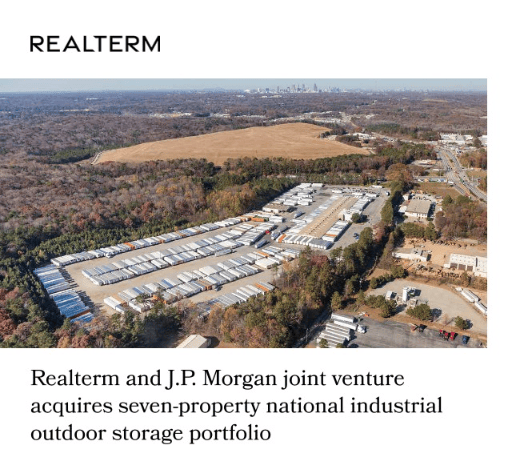

ACQUISITION: Realterm, in partnership with institutional investors advised by J.P. Morgan Asset Management, acquired a seven-property national industrial outdoor storage (IOS) portfolio across key U.S. transportation markets. The portfolio includes six truck terminals and one truck fleet maintenance facility, expanding Realterm’s footprint and strengthening its leadership in transportation real estate.

ACQUISITION: CanTex Capital sold an eight-property, 44-acre industrial outdoor storage portfolio in Dallas–Fort Worth to Stockbridge Capital Group. The fully leased, institutional-quality portfolio spans key infill submarkets such as Brookhollow, Garland, Great Southwest, and East Fort Worth. Eastdil Secured served as the exclusive advisor to CanTex on the transaction.

RECAP: Greenspring Realty Partners completed a portfolio recapitalization with WinTrust, encompassing nine value-add industrial assets across Florida, Virginia, and Arizona. The transaction marks another milestone in GRP’s expansion within the industrial outdoor storage and heavy industrial sectors. Terry Sutherland of WinTrust and Justin Horowitz of Cooper-Horowitz assisted in bringing the deal to completion.

ACQUISITION: Triten Real Estate Partners acquired a 4-property, fully leased light industrial portfolio totaling nearly 500,000 SF across Houston’s Northwest and East submarkets. The infill assets feature smaller-than-average suite sizes, immediate scale, and proximity to major freight corridors. The off-market transaction was led by Will Hedges and Keith Gabrielson, with support from Trent Agnew and the JLL team.

ACQUISITION: Alterra IOS announced the acquisition of 12 Class A IOS properties, totaling 43.3 usable acres with over 165,000 square feet of accompanying warehouse space. The properties are situated in key metropolitan areas across the country, including Austin, Phoenix, Raleigh-Durham, Sacramento and Tampa. All of the properties in the portfolio are fully leased, featuring newly constructed locations built-to-suit for the tenant. The locations included in this transaction are:

Kings Mountain, N.C. (Charlotte MSA): 7.0 usable acres with 20,950 square feet

Port Allen, La. (Baton Rouge MSA): 5.8 usable acres with 23,060 square feet

Malabar, Fla. (Palm Bay MSA): 4.9 usable acres with 19,700 square feet

Apache Junction, Ariz. (Phoenix MSA): 4.2 usable acres with 10,850 square feet

Conway, S.C. (Myrtle Beach MSA): 3.6 usable acres with 10,850 square feet

Wilmington, N.C. (Wilmington MSA): 3.0 usable acres with 14,400 square feet

Sacramento, Calif. (Sacramento MSA): 3.0 usable acres with 9,440 square feet

Monroe, La. (Monroe MSA): 2.7 usable acres with 15,250 square feet

Austin, Texas (Austin MSA): 2.5 usable acres with 9,600 square feet

Ocala, Fla. (Ocala MSA): 2.4 usable acres with 15,110 square feet

Tampa, Fla. (Tampa MSA): 2.4 usable acres with 9,440 square feet

Wake Forest, N.C. (Raleigh-Durham MSA): 1.6 usable acres with 10,800 square feet

This acquisition was brought to Alterra IOS by Rory Shelby and Scott Gould of Marcus & Millichap.

REFINANCING: JLL Capital Markets has secured $231 million in financing for a 43-property IOS portfolio totaling 293 acres across 13 states on behalf of Jadian Capital’s affiliate, JIOS. The portfolio spans 19 markets and includes major tenants such as United Rentals, Waste Management, Ryder, ABF Freight, and a top national e-commerce company.

ACQUISITIONS: CBRE successfully closed a Houston Infill IOS Portfolio, one of the largest IOS transactions in Texas history. The 117-acre, 11-property value-add portfolio is strategically located just east of Downtown Houston and was 92% leased at the time of sale. With an average WALT of 2.96 years, a diversified tenant base, and a 37% mark-to-market upside, the portfolio offers strong prospects for future growth.

REFINANCING: Zenith closed a $120M refinance for two regional industrial outdoor storage portfolios covering 30 locations across the US. They partnered with Washington Capital and Justin Horowitz of Cooper Horowitz, LLC on this transaction.

PORTFOLIO SALE: Catalyst Investment Partners has successfully sold and recapitalized two IOS portfolios, comprising 18 properties across seven high-barrier-to-entry East Coast markets, for a total of $163.5 million. These properties, acquired over the past four years, are leased to tenants in industries such as equipment rental, e-commerce, logistics, home services, building materials, and infrastructure. In March 2024, Catalyst closed its second IOS fund oversubscribed with $187 million in discretionary capital commitments.

ACQUISITION: Open Industrial announced the portfolio acquisition of four IOS properties totaling 7.7 acres with over 64,000 SF of industrial improvements located across North Carolina and Virginia. The Properties located in Richmond, Rocky Mount and Winchester are fully leased to Gregory Poole Equipment Company CAT. The Property located in Chesapeake is fully leased by Aggreko. Michael Hutton, Chad Pitts, Blake Potolicchio and Matt Potolicchio led the The Open Industrial team. The seller was represented by Bo McKown, Eric Robison, and Gregg Beck of Cushman & Wakefield | Thalhimer.

———

CORRECTION: We’ve updated the acquisition at 152 Molly Walton Drive in Hendersonville, TN — the correct sale price is $6.2M (previously reported on December 23rd as $8.2M).

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,100+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

🚀To advertise with IOS YardDogs (for lease / for sale listings, vendors),

email: [email protected]

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.