YardDogs -

Miss any industrial outdoor storage (IOS) activity in Q4 2025? We’ve got you covered with the biggest deals of the year.

In today’s email:

Top Transactions: We’re featuring some of the top transactions of Q4 2025. Let us know if you had others that should be on the podium!

IOS YARDDOGS TOP DEALS

Q4 2025

FINANCING: Wintrust has recapitalized a fully leased, three-property industrial outdoor storage portfolio totaling 16.7 acres in San Bernardino, CA, within the Inland Empire market. The stabilized sites are 100% leased and strategically located in one of the country's most supply-constrained and in-demand logistics regions.

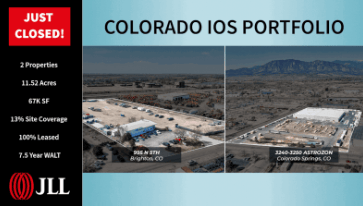

ACQUISITION: JLL has closed the sale of a two-property IOS portfolio totaling roughly 67,000 square feet across 11.5 acres along Colorado’s Front Range. Both single-tenant assets were fully leased at the time of sale and carried an average remaining lease term of 7.5 years, underscoring strong tenant commitment and stability.

ACQUISITION: DAUM Commercial closed the sale of a 19.57-acre IOS property in Ontario, CA, featuring 13 buildings and 50,000 SF of space in the heart of the Inland Empire. The buyer, an Austin-based owner/operator focused on truck terminals, capitalized on the site’s connectivity and functionality, underscoring the continued resilience of the Inland Empire industrial market.

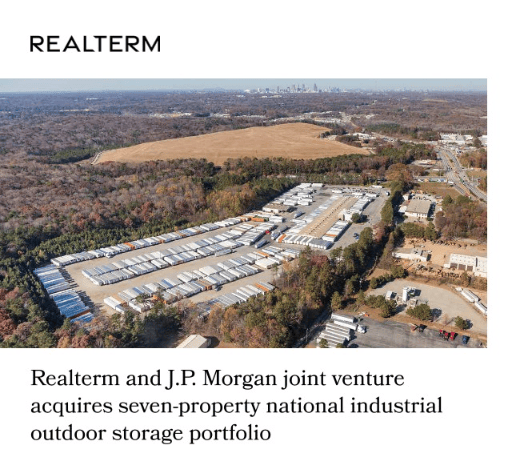

ACQUISITION: Realterm, in partnership with institutional investors advised by J.P. Morgan Asset Management, acquired a seven-property national industrial outdoor storage (IOS) portfolio across key U.S. transportation markets. The portfolio includes six truck terminals and one truck fleet maintenance facility, expanding Realterm’s footprint and strengthening its leadership in transportation real estate.

RECAP: Greenspring Realty Partners completed a portfolio recapitalization with WinTrust, encompassing nine value-add industrial assets across Florida, Virginia, and Arizona. The transaction marks another milestone in GRP’s expansion within the industrial outdoor storage and heavy industrial sectors. Terry Sutherland of WinTrust and Justin Horowitz of Cooper-Horowitz assisted in bringing the deal to completion.

ACQUISITION: IronHorn is pleased to announce the acquisition of a 38,280 SF cross-dock facility at 6101 Lindsey Road in Little Rock, AR. Situated on 7.33 secure, fenced acres, the property offers 56 dock-high doors, four drive-ins, and 24' clear height - ideal for high-throughput operations. Its strategic location directly off I-440, with fast access to I-40, I-30, and the Port of Little Rock, positions users at the heart of a highly connected logistics network. With more than 25,000 trucks traveling I-40 daily and over 90 million consumers within a day’s drive, this site delivers exceptional regional reach. This acquisition underscores IronHorn’s commitment to expanding its industrial outdoor and logistics-focused portfolio in key transportation corridors.

ACQUISITION: Kenai Capital Advisors represented Bamboo Equity Partners in the sale of a two-asset industrial outdoor storage portfolio totaling 36,321 square feet across 6.45 acres in Denver, CO and Oklahoma City, OK. The properties include a 10,000-square-foot ISF in Denver and a 26,321-square-foot industrial building in Oklahoma City, each offering drive-in loading, outdoor storage, and strong regional connectivity. The buyer, a California-based private investor, acquired both assets through a publicly marketed process.

ACQUISITION: Virtue Real Estate Partners closed the sale of a two-property IOS portfolio in Houston and Tulsa totaling 52,393 square feet on 14.71 acres. The fully leased assets were sold in an off-market transaction, with Virtue representing Alterra IOS.

IOS Resources

IOS Underwriting Model (Free)

Link to All Market Monday Reports

📢 LIST YOUR PROPERTIES Reach 5,100+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

🚀To advertise with IOS YardDogs (for lease / for sale listings, vendors),

email: [email protected]

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.