YardDogs -

This week’s roundup of industrial outdoor storage (IOS) activity includes multi-market transactions in Florida, Texas, and beyond.

In today’s email:

Transactions: FL, SC, AZ (2) and the Netherlands! Plus leases signed in OH and FL!

Recs: Check Out Nick Watson’s Case Study in Sarasota, FL

CLOSED TRANSACTIONS

Acquisitions and Dispositions

ACQUISITION: 17339 Brandy Branch Rd in Jacksonville, FL was just sold! This IOS property features over 14K SF across 2 buildings on 10 AC. The site is strategically located near I10 and I295. Mike Salik at Matthews Real Estate Investment Services facilitated this deal!

ACQUISITIONS: URBZ Capital in conjunction with NW1 Partners announced the acquisition of 4 Industrial Outdoor Storage (IOS) assets across 3 separate transactions in early 2025! With these acquisitions, the partnership is strengthening their footprint across the Netherlands. The assets are located in Rotterdam (Papendrecht), Waalwijk, Breda & Apeldoorn and feature 100,000+ sqm land area. The properties are fully leased to reputable tenant customers. PFRE, Oerlemans Real Estate, Verona Real Estate, DLA Piper, Savills, ERM, and Dils and Houthoff have aided during these acquisitions.

ACQUISITION: Alterra IOS recently acquired 2830 Rivers Avenue, North Charleston, SC! The site features 4.02 usable acres with a 9,240 SF maintenance building. The site is located proximate to I-26. Charlie Totten led this transaction and Alex Shields of Bridge Commercial provided assistance!

ACQUISITION: Last week, IOS Southwest LLC acquired their newest asset - a ±2,740 SF warehouse on ±1.67 AC in Apache Junction, fully leased through September 2027. The team at R&G, including Max Schumacher, SIOR Patrick Sheehan, Jack Hansen, facilitated the transaction!

ACQUISITIONS: Alignment Realty Capital closed on two buildings totaling 100,530 SF on 12.5 acres in Mesa, AZ - adjacent to the top performing Costco in the Phoenix MSA. The 100%-leased, low-coverage site has 6+ years of WALT and more than half of the space is leased to POOLCORP (NASDAQ: POOL). A portion of the improved excess land is currently leased for vehicle storage but may be developed or sold in the future. Stein Koss, Tom Louer, & Fenton Kelly helped on this closing!

LEASES SIGNED

Recently Leased Properties

LEASED: 2976 Lazar Rd in Grove City, OH was just leased! The property featured 2 AC of improved outdoor storage space. Simon Kroos at NAI Ohio Equities represented the landlord in the transaction and the site was leased to a managed truck parking user.

LEASED: On behalf of Stockbridge, the Foundry team of Justin Ruby, Caitlin Guinlan, and Jesse Drake just leased a 6.67-acre industrial site with +/- 25,000 SF of warehouse space. They had an LOI on the property before it was ever on the market. Devin Beeler and Robbie Lober at Lober Real Estate helped connect the right user to the right site quickly.

REC

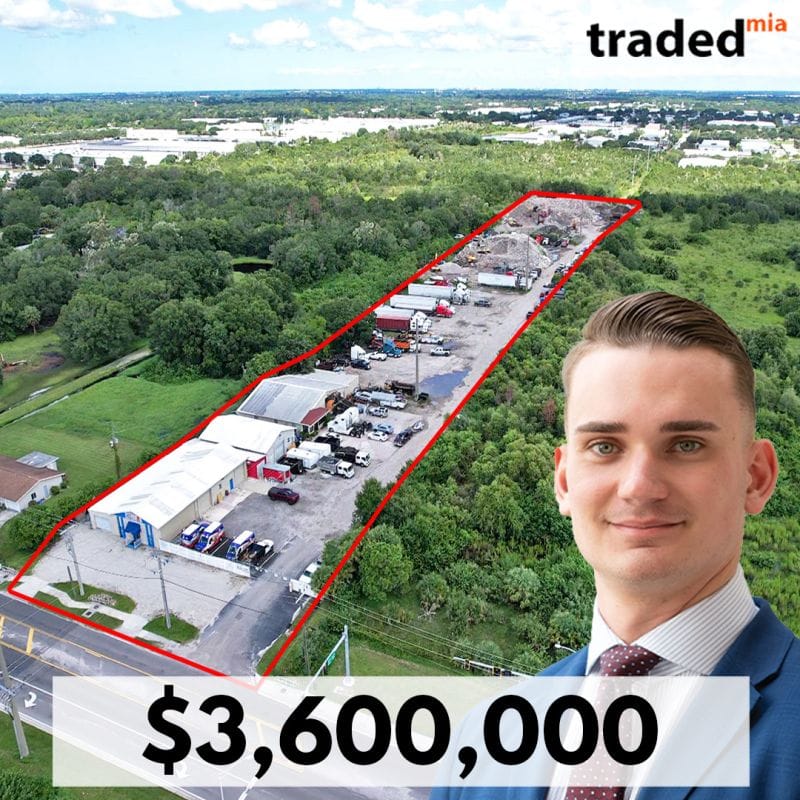

Case Study — Sarasota, FL

Some deals require some outside the box thinking — like Nick’s deal in Sarasota, FL that recently closed.

The Challenge: The owner-users previously signed tenants on long-term, below-market gross leases that covered fragmented areas of the site. The structure made it challenging for a new owner-user to justify the acquisition, and the income couldn’t support the seller’s target price.

The Approach: Nick structured a single-tenant NNN master leaseback that blanketed 100% of the property — including the existing below-market tenants — and included a sublet clause.

While under contract, they also secured a tenant to occupy a portion of the site. This new lease added tremendous value for the buyer and relieved a large portion of the master leaseback obligation for the seller.

The Result: multiple offers, a strong price, and a win-win for all parties.

Congrats to Nick and all involved on this!

New to IOS?

Start with our guide: What is Industrial Outdoor Storage?

Got Deals?

Get your listings in front of the right people! If you have an IOS sale or lease listing (or something else you want to highlight), just shoot us an email at [email protected] and we’ll make sure it reaches the right audience.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.