YardDogs -

We’re highlighting the top industrial outdoor storage (IOS) leases and sales every week and in this edition, we cover transactions in Florida and Texas.

In today’s email:

Transactions: Acquisitions in TX (2) and FL (2). Plus a fully leased site in FL!

On the Market: Lease listings in Auburn, WA and New England

Recs: Overview of Charlotte IOS with Greg Gosselin

CLOSED TRANSACTIONS

Acquisitions & Dispositions

ACQUISITION: First Houston Properties closed the sale of a Class-A urban-core industrial property at 6287 Long Drive in Houston, TX. The deal was led by James Mashni with contributions from Jared Edelman and Patrick McBreen. The transaction reflects continued investor demand for high-quality industrial and IOS assets in Houston’s infill market.

ACQUISITION: Dalfen Industrial announced the acquisition of an IOS property in Apopka, Florida, located at 2916 Apopka Blvd and 8188 N Orange Blossom Trail. The 2.61-acre site is 100% leased and strategically positioned along US 441 and State Road 414 within the I-4 Industrial District.

ACQUISITION: Lober Real Estate closed the sale of an IOS property at 5907–6001 E Columbus Dr. in East Tampa, FL. The 1.73-acre site includes an 11,020 SF warehouse and drew strong interest from both buyer and seller, with the deal successfully navigated to closing.

ACQUISITION: Panther Capital Group closed a 1.54-acre IOS site at 910 Pellegrino Ct. in Laredo, TX. The property features M1 zoning suitable for trucking, trailer parking, and yard-intensive uses and is part of a two-property Pellegrino Ct. portfolio. The transaction was led by Ruben Larrea, Senior Advisor for Industrial Investments at Panther Capital Group, highlighting continued IOS investment in key South Texas logistics corridors.

RECENT TRANSACTIONS

Leased

LEASED: LH Capital Partners completed a long-term lease at 2501 Industrial St. in Leesburg, FL, securing a national building supply company as the tenant. The property includes a 40,000 SF industrial building paired with 1.5 acres of outdoor storage, offering prime functionality for distribution and material storage. The transaction highlights strong leasing momentum for IOS and warehouse assets in Central Florida.

ON THE MARKET

For Lease

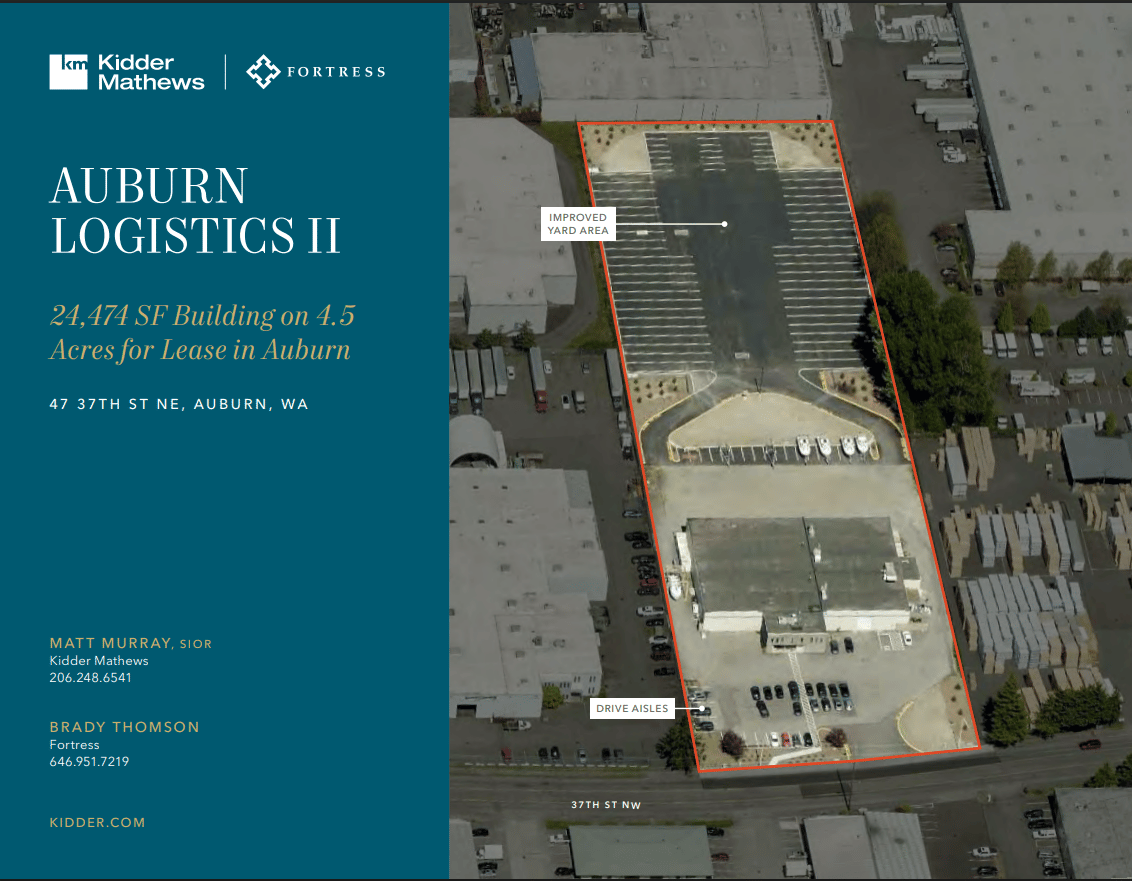

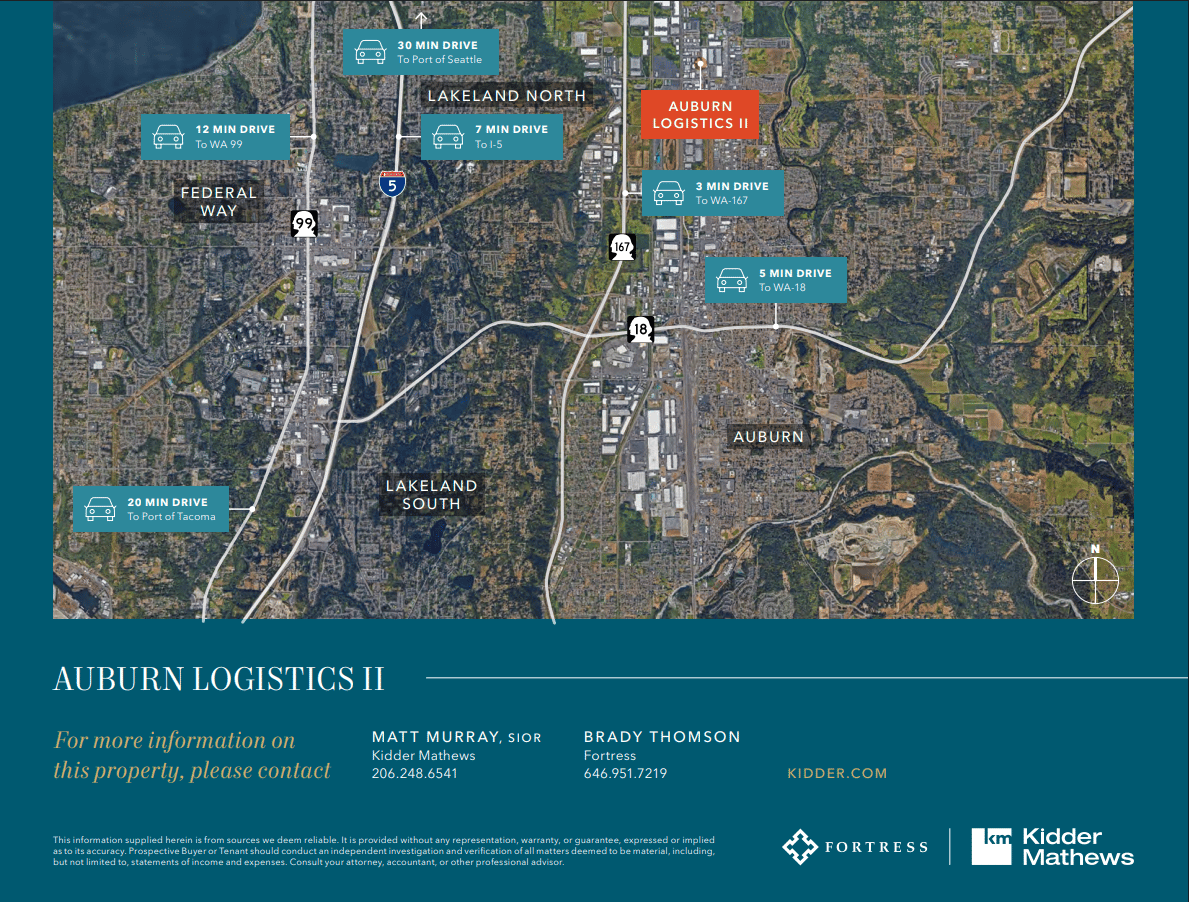

FOR LEASE: 24,474 SF Building on 4.5 Acres for Lease in Auburn, WA

Property Overview:

Construction on yard complete; building to undergo improvements soon

4.5 AC total 24,474 SF total building 3,740 SF total office

Multiple drive through bays

Paint booth 800 Amp, 277/480V, 3-Phase Power Service

Fully fenced

New LED exterior lighting throughout the property

Ownership willing to make specific improvements

Reach out to Matt Murray at Kidder Matthews for more information [email protected] | 206-248-6541

FOR LEASE: Two adjacent industrial outdoor storage (IOS) yards totaling 2.48 acres are available for immediate lease at 114 and 128 Spring Street. The sites can be leased together or separately (0.95 and 1.53 acres) and offer a mix of concrete and gravel surface, full perimeter fencing, and 24-hour secure access. Power, water, and sewer are available on-site, providing flexibility for a variety of uses including fleet parking, equipment storage, contractor operations, or laydown yard needs. Reach out to David Skinner at Prescott IOS for more info.

Other Resources

IOS Underwriting Model (Free)

Market Mondays

Nashville

San Antonio

📢 LIST YOUR PROPERTIES Reach 5,000+ IOS investors, operators, and industry professionals in our engaged community.

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.