YardDogs -

WE ARE BACK – welcome back to a new and improved edition of Market Monday! Today we’re taking a look at San Antonio, TX.

In today’s email:

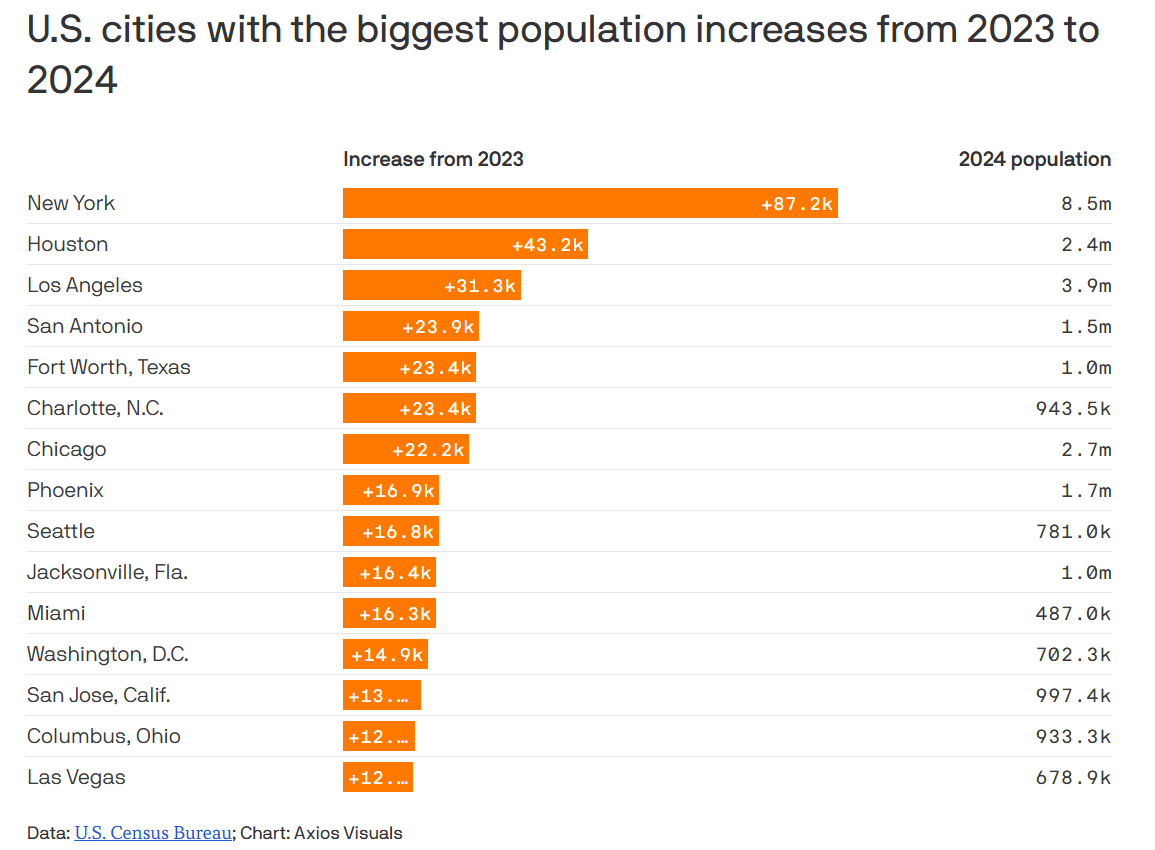

Market Overview: San Antonio continues to post one of the fastest population growth rates in the country, adding nearly 24,000 residents last year. The industrial vacancy rate sits just under 9%, supported by strong fundamentals in construction, logistics, and manufacturing.

The IOS Opportunity: Lease rates initiated between Q4 2023 and 2025 average roughly $4,700 per month per acre — up about 10% year over year. The median price per acre during that time was approximately $750,000.

Market Fundamentals: Industrial land remains significantly cheaper than Austin, and infrastructure investments like Loop 1604 and I-10 upgrades are improving access. I-1 and I-2 zoning districts provide flexibility and smoother permitting than other Texas metros.

IOS Landscape: Recent sales and leases highlight steady absorption across the I-35 corridor — particularly in the Northeast and Northwest submarkets — where improved infrastructure and nearshoring proximity are driving activity. Don’t miss opportunities to own or lease in San Antonio towards the end of this newsletter.

Local Brokers & Market Experts: Scroll to the bottom for a list of active IOS brokers, tenant reps, and investor contacts shaping the San Antonio market.

MARKET OVERVIEW

The Alamo City’s Momentum

San Antonio added nearly 24,000 residents between July 2023 and July 2024—the fourth fastest-growing city in America.1,2 The nation's seventh-largest city (1.53 million) is on track to surpass Philadelphia within the next few years, with a metro area of 2.8 million.3,7

The growth is strategic, not random. Over 59% of the metro's 205,000 new residents since 2020 came from other states, drawn by affordability and opportunity.[4] The region's economy has surged past $190 billion—up 60% in a decade—while maintaining a cost of living 8-9% below the national average.5,6

Economic diversity drives stability. Major employers like Joint Base San Antonio, H-E-B, USAA, and a growing tech sector anchor the market. At 3.7%, unemployment runs below state and national averages.8 Manufacturing, construction, and logistics sectors continue adding jobs—creating the exact conditions that drive IOS demand.

San Antonio's I-35 position is its superpower. The nearshoring wave from Mexico is already here—industrial inventory hit 88.9 million square feet with median rents at $7.53/SF annually.9 Union Pacific's 32,000-mile rail network provides direct access to U.S., Canadian, and Mexican markets without gateway city congestion.10 Vacancy rates for IOS facilities are a bit hard to track, but the industrial market in the area is hovering just below 9% as of Q4 2024.

IOS OVERVIEW

San Antonio IOS Opportunity

Industrial outdoor storage serves critical needs that traditional warehouse space can't: equipment storage, vehicle parking, and materials staging. While the broader industrial market gets attention, IOS remains relatively underexplored.

Recent IOS lease transactions initiated between Q4 2023 and 2025 average approximately $4,700 per month per acre. The median price per acre of IOS sales during that same time period was approximately $750,000.

Lease rates have increased by roughly 10% year over year, reflecting sustained tenant demand. Of the leases reviewed, the median site size is about three acres, typically single-tenant occupied. Roughly one-quarter of leases reviewed were with nationally recognized, blue-chip operators, while the balance comprises regional and local service providers across the construction, logistics, and energy infrastructure sectors.

Key Areas

Northeast (I-35 corridor): Most active for IOS demand / sales, driven by proximity to distribution and manufacturing. Northwest (Loop 1604): Emerging growth area as interchange improvements progress. South (I-35 south): More affordable entry points with solid trade route access.

“Northeast San Antonio seems to have the most tenant activity with the growth in the San Antonio/Austin I-35 corridor being the driver. This holds true on the sale side as buyers seem more comfortable with the North / Northeast submarkets and are willing to pay a tighter cap rate for similar credit tenants. IOS has still shown to have lower vacancy and more activity than traditional industrial.” - Reid Halverson, Newmark

Demand drivers mirror regional strengths: construction companies need staging areas; logistics operators require trailer/container parking; military contractors need vehicle storage; energy sector (Eagle Ford, Permian Basin proximity) demands oilfield equipment space; food distributors serving H-E-B need trailer staging. There is good representation from stable, credit-worthy tenants across the market.

Facilities offering concrete or asphalt paving, security fencing, 24/7 access, and utilities command premium rates and often attract good credit tenancy. Class A caliber properties are particularly sought after by investors in the San Antonio market.

Market Fundamentals Driving IOS in San Antonio

Land Values & Opportunity Zones: Industrial land runs significantly cheaper than Austin while offering comparable access. Opportunity Zone areas provide tax advantages for long-term investors.

Infrastructure Investment: Multi-year, multi-billion dollar improvements to Loop 1604/I-10 and major corridors are reshaping accessibility. Early positioning can capture value ahead of completion.

Regulatory Environment: I-1 and I-2 zoning districts offer flexibility. Permitting can be smoother than in other major metros, and property tax structures remain regionally competitive.

Comparative Advantage: Austin's land costs have priced out many users. Dallas-Fort Worth brings higher operating costs. Houston faces port concerns and insurance premiums. San Antonio delivers accessibility without some of the premium compared to other markets.

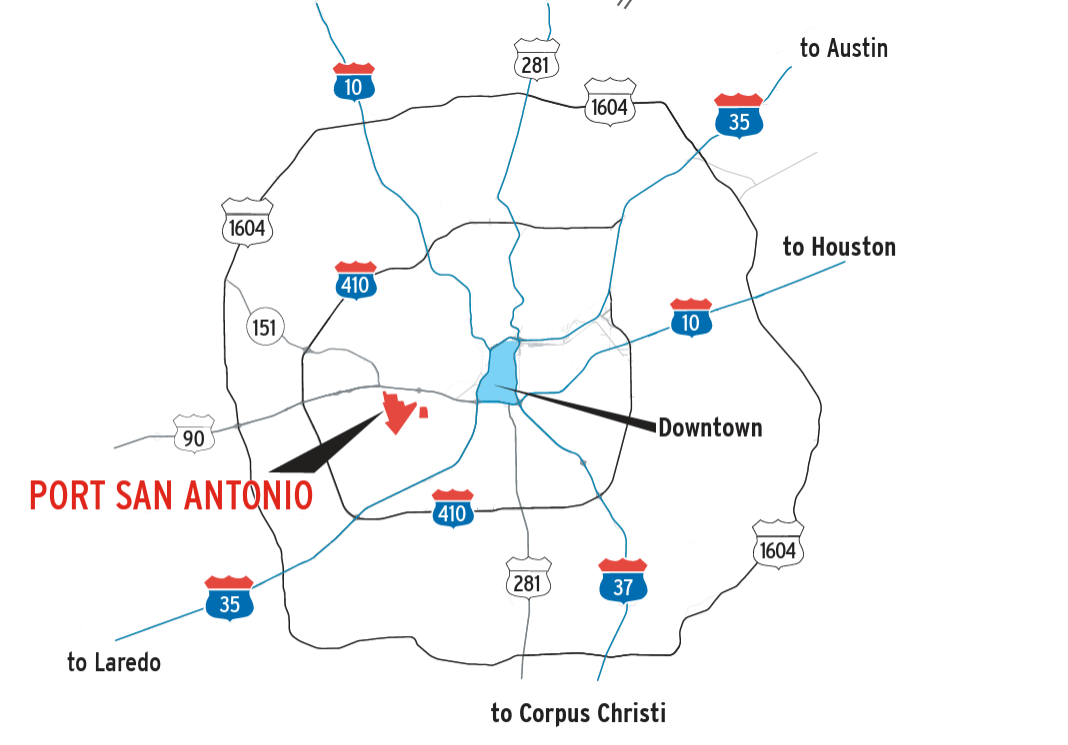

Transportation & Access: Beyond I-35, the market offers Union Pacific rail, San Antonio International Airport for air freight, and Port San Antonio (former Kelly AFB) as a major inland logistics hub. Critical for logistics infrastructure as well as proximity to population growth.

Labor Market: Metro population of 2.8 million provides deep labor pools. UTSA, Trinity, and St. Mary's graduate thousands annually. The median age is 34.6 which is healthy for the workforce.11

“We find more favorable pricing and deal economics in the San Antonio MSA compared to the greater Central Texas region. This favorable investor and tenant environment is fueling higher transaction volumes in the IOS space. New players are looking into the market weekly; submarket areas that only a year or so ago were ‘off limits’ to institutional equity investment are now very much on the table and realizing growing interest and pricing as new competition moves into those markets.” - Colten Courtney, on behalf of the Partners Real Estate Industrial Team (San Antonio & Austin)

The bottom line: San Antonio offers cheaper entry than Austin, operational advantages over Houston, strategic I-35 positioning, and opportunities across multiple price points and risk profiles.

FEATURED LISTINGS

San Antonio

647 N WW White Rd Infill IOS Redevelopment 16.8 Acres (I-2 Heavy Industrial zoning) | For Lease

Partners Real Estate, together with the landlord Outpost (https://outpost.us/), is in the process of demolishing over 230,000 SF of improvements to repurpose a 16.8-acre former steel plant in San Antonio, TX. Above is a high-level conceptual rendering of what’s possible for IOS build-to-suits. The property is zoned I-2 (Heavy Industrial) with close proximity to Interstate 10 East, Hwy 35, Loop 410, and Loop 1604.

Please note that the above conceptual plan is for illustrative purposes only and remains subject to change.

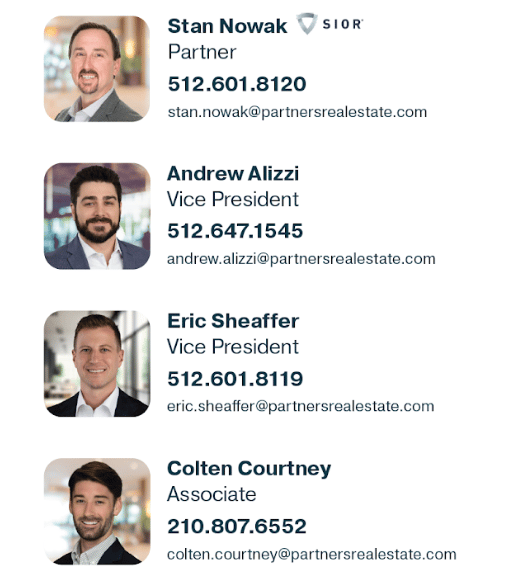

Please reach out to Stan Nowak, Andrew Alizzi, Eric Sheaffer, and Colten Courtney for more information.

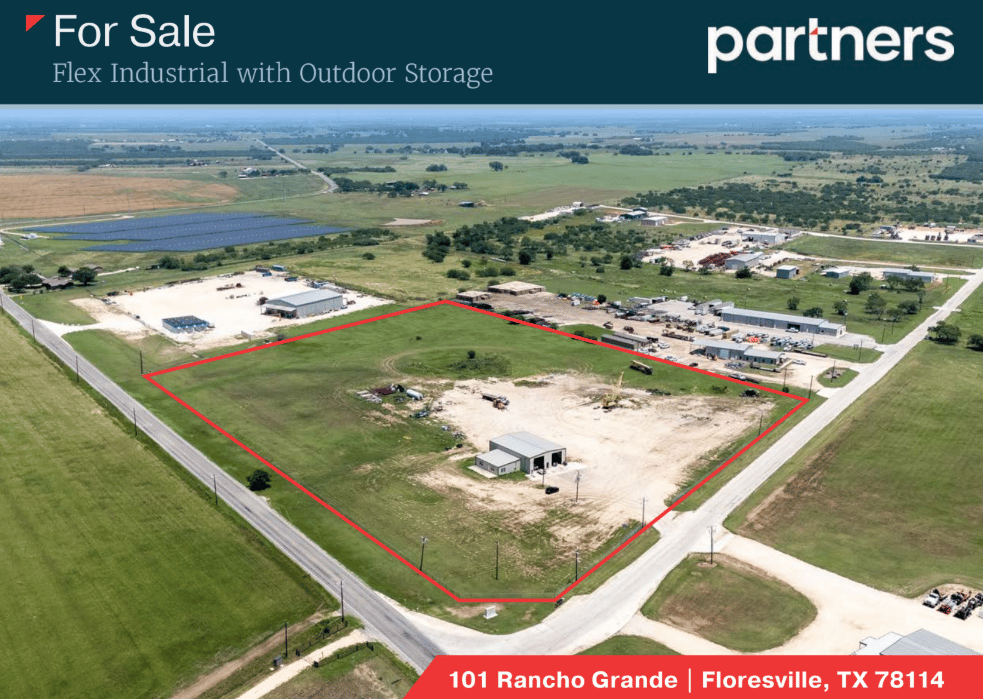

101 Rancho Grande – Floresville, TX | For Sale

A ±14.40-acre IOS property located one mile north of US Highway 181 in Floresville, offering easy access to San Antonio’s southern industrial corridor. The site includes a ±3,500 SF warehouse with two drive-through bays, a fenced and stabilized yard, and sits outside city limits, providing flexible use potential. Built in 2013, the property is well-suited for contractors, equipment storage, or service operations needing large yard space with on-site improvements.

Please reach out to Stan Nowak, Andrew Alizzi, Eric Sheaffer, and Colten Courtney for more information.

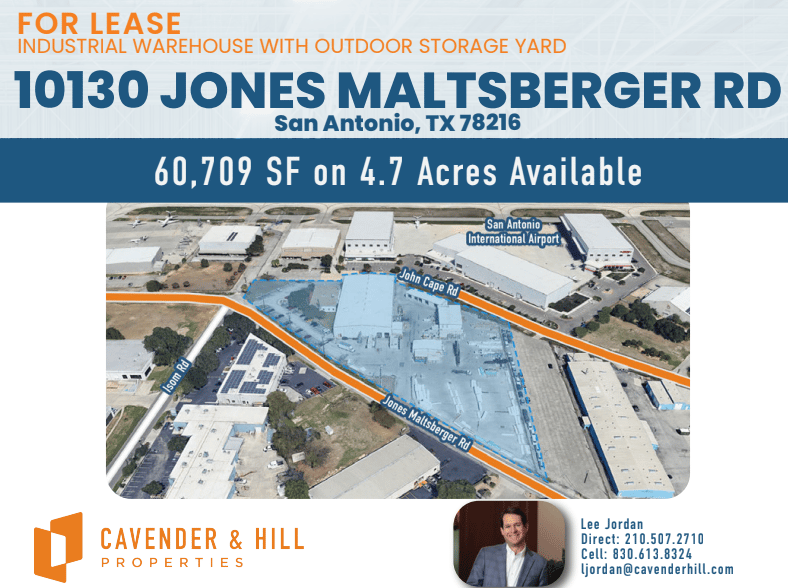

10130 Jones Maltsberger Rd – San Antonio, TX | For Lease

A ±60,709 SF facility on 4.7 acres located adjacent to San Antonio International Airport within the North Central submarket. The property includes a 51,341 SF main building (with showroom and office space) plus 9,368 SF of detached buildings and approximately 2.5 acres of outdoor storage. Features include five dock-high doors, two ramped doors, 22’–25’ clear heights, a sprinkler system, and strong connectivity to US-281 and Loop 410. Ideal for logistics, distribution, or light manufacturing users seeking proximity to major thoroughfares.

Please reach out to Lee Jordan for more information.

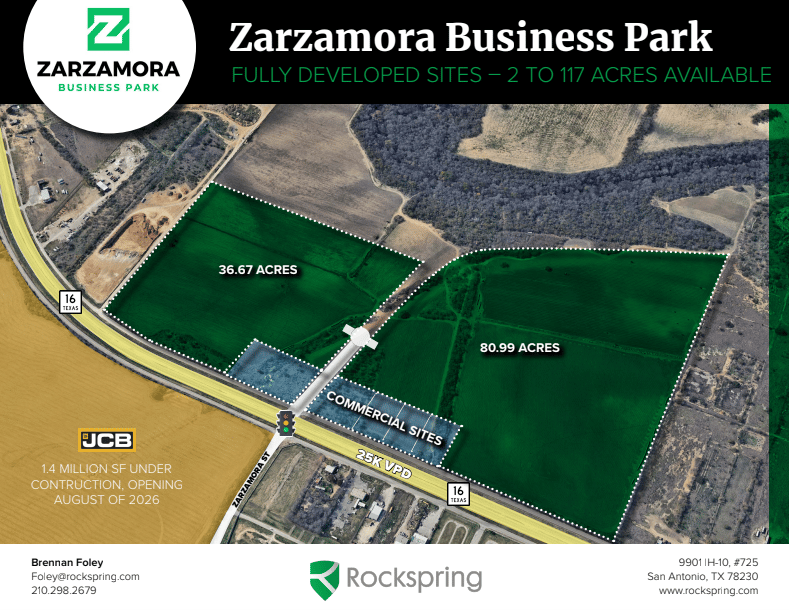

Zarzamora Business Park – San Antonio, TX

Located at the signalized intersection of Kelly Parkway and Zarzamora Blvd along Highway 16, Zarzamora Business Park offers up to 117 acres of fully developed industrial land, divisible to suit. Utilities are in place (SAWS water and sewer, CPS electric), and the site is zoned I-1, allowing for Industrial Outdoor Storage (IOS) uses. With 25,100 vehicles per day, direct access to Loop 410, I-35, and US-281, and proximity to major manufacturers like JCB, Toyota, and Navistar, the park is ideal for suppliers, logistics operators, and industrial users seeking scalable land positions with excellent visibility and infrastructure.

Reach out to Brennan Foley for more information.

LOCAL EXPERTS

Local Brokers & Market Experts

Big thanks to all the brokers who helped shape this week’s Market Monday in San Antonio. If you’re looking to buy, sell or lease in SATX, the people below are the ones to call!

Partners Real Estate Team

Newmark

Reid Halverson, Managing Director

E: [email protected] P: 972-715-4371

Cavender and Hill

Lee Jordan, SIOR

E: [email protected] P: 210-507-2710

Obsido Commercial

Joshua Swank, Managing Partner

P:210.809.6868

E:[email protected]

Ron Kotel, Partner

P:210.809.6868

E:[email protected]

SOURCES & REFERENCES

1: U.S. Census Bureau. (2025). San Antonio population growth data. Retrieved from Texas Public Radio, "U.S. Census: San Antonio may soon surpass Philadelphia as nation's 6th largest city" (May 20, 2025)

2: San Antonio Current. (2025). "San Antonio ranks as nation's fourth fastest-growing city, new Census numbers show" (July 22, 2025)

3: Axios San Antonio. (2025). "Census Bureau: San Antonio still a top city for population growth" (May 16, 2025)

4: Axios San Antonio. (2025). "Census: San Antonio population boom driven by out-of-state movers" (March 13, 2025)

5: Axios San Antonio. (2025). "San Antonio economy surpasses $190B" (August 13, 2025)

6: Crexi. (2024). "San Antonio Commercial Real Estate Market Report 2025"

7: Texas Public Radio. (2025). U.S. Census data showing San Antonio at 1,526,656 population, trailing Philadelphia by 47,000 residents. "U.S. Census: San Antonio may soon surpass Philadelphia"

8: Federal Reserve Bank of Dallas. (2025). "San Antonio Economic Indicators"

9: Crexi. (2024). San Antonio industrial market inventory and rent data. "San Antonio Commercial Real Estate Market Report 2025"

10: Prologis. (2025). "San Antonio Industrial Logistics and Warehouses" (May 7, 2025)

11: World Population Review. (2025). "San Antonio, Texas Population 2025" - Demographic data including median age.

New to IOS?

Start with our guide: What is Industrial Outdoor Storage?

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.