Market Monday: Minneapolis, MN

Summary:

Market Overview: Minneapolis–St. Paul’s population growth has remained steady over the past decade, supported by a diversified economic base, stable in-migration, and continued infrastructure investment across the metro. Industrial vacancy remains tight relative to long-term averages, even as new product delivers. As the metro evolves, limited infill land, fragmented zoning across municipalities, and entitlement complexity are expected to deepen competition for well-located IOS sites, reinforcing the Twin Cities’ role as a critical logistics and service hub in the Midwest.

The IOS Opportunity: Lease rates initiated between 2023 and 2025 range from approximately $5.5K to over $12K per acre per month, with average pricing clustering in the $8.5K–$9K range. Well-located sites with appropriate zoning, functional layouts, and immediate highway access continue to command premiums, while constrained inventory and zoning friction have helped support pricing stability. Leases initiated typically feature buildings of roughly 10,000 square feet situated on approximately three acres.

Market Fundamentals: Minneapolis–St. Paul’s industrial ecosystem is anchored by extensive multimodal connectivity — I-94, I-35, I-494, I-694, regional rail networks, river access, and proximity to MSP — supporting freight, construction, utilities, and service-sector users that depend on outdoor storage. Ongoing public and private investment in transportation infrastructure and airport expansion continues to reinforce long-term demand.

Local Brokers & Market Experts: Scroll to the bottom for a list of active IOS listings and experts shaping the Minneapolis market — special thanks to CBRE and JLL for participating!

Active Listings and Recent Deals: Minneapolis Listings and Recent Deals

If you want to participate in a future Market Monday, email [email protected]

MARKET OVERVIEW

Minneapolis

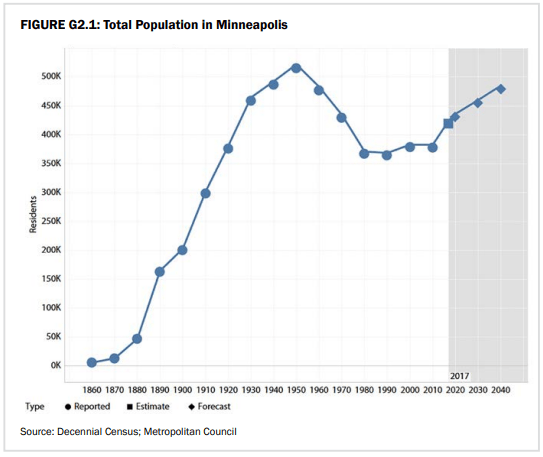

The Minneapolis–St. Paul metro remains one of the most important logistics, distribution, and service-oriented industrial hubs in the Upper Midwest, supported by steady population growth, a diversified economic base, and a highly connected transportation network anchored by I-94, I-35, I-494, I-694, and Minneapolis–St. Paul International Airport (MSP). The Twin Cities’ central geography and deep infrastructure base continue to attract regional and national operators across construction, utilities, equipment rental, and fleet-based service industries. Population has continued to increase since ~2010 and is forecasted to maintain that trend.1

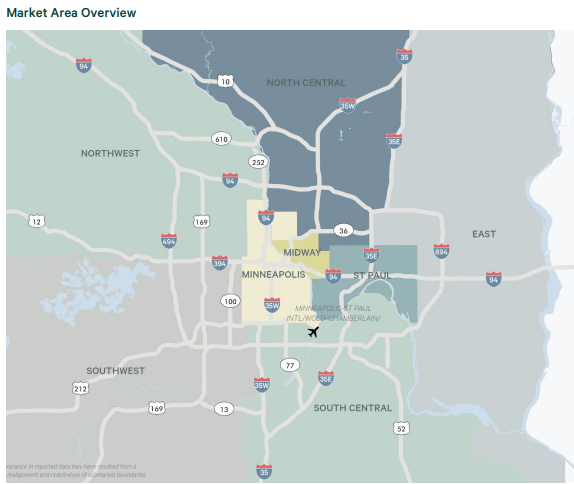

Freight connectivity is a defining advantage for the metro. The region serves as a critical crossroads for north–south and east–west truck traffic, with efficient access to Chicago, Milwaukee, Kansas City, and the Dakotas. MSP consistently ranks among the busiest airports in the country by passenger volume and cargo throughput, while the Mississippi River and regional rail infrastructure support broader freight movement across the Midwest. These logistics fundamentals underpin durable industrial demand and a steady pipeline of IOS users reliant on efficient regional coverage.

Industrial fundamentals remain healthy, even as broader leasing activity moderated over the past year. Leasing momentum has begun to re-accelerate, particularly among IOS users seeking infill locations. As Myles Harnden of CBRE notes, “Leasing activity and demand has picked up in the last three months, although the prior 12 months were more sluggish. Sales remain very competitive and tight, with pricing starting to return to — and in some cases exceed — the all-time highs of 2022.”

Tenant demand remains concentrated in functional infill locations, particularly inside the I-494/I-694 loop. Jack Nei of JLL highlights that “the Twin Cities IOS sector remains competitive inside the 494/694 loop mainly due to limited available inventory. The most active tenants are equipment rental companies, building material suppliers, and both local and national construction companies, with 2–5 acre infill sites driving most of the IOS demand.”

Owner-users have also re-emerged as a meaningful source of activity, seeking long-term control of properties that support fleet operations and service routes across the metro. While speculative development of IOS product remains limited, well-located sites continue to generate strong interest when appropriately zoned and configured.

Across the Twin Cities, the foundation remains consistent: a diversified economy, strong freight flows, and persistent demand from industries that rely on outdoor storage to support day-to-day operations.

IOS OVERVIEW

Minneapolis IOS Opportunity

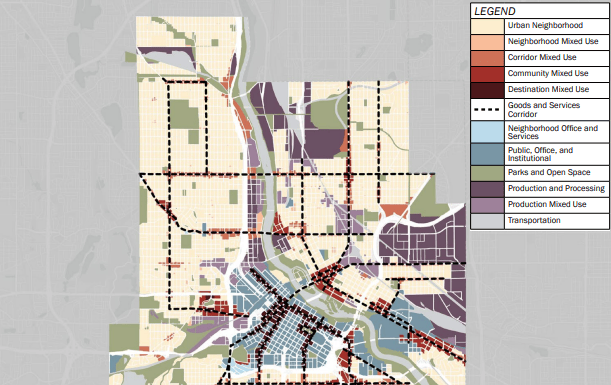

Minneapolis–St. Paul remains a structurally constrained IOS market. Infill industrial land suitable for outdoor storage is limited, zoning for yard-intensive uses varies widely by municipality, and redevelopment pressure continues to reduce existing IOS inventory. “Each city in the nine-county MSA has its own zoning ordinances and planning departments regulating land uses,” notes Jack Nei of JLL, creating additional complexity for both investors and occupiers.

Despite moderated activity over the past year, IOS demand remains durable and rooted in the region’s economic base. Construction contractors, utility and telecom providers, environmental services firms, equipment rental companies, and transportation operators continue to rely on secure outdoor storage as a core component of their operations. These users prioritize proximity to highways, population centers, and service territories — characteristics that are increasingly scarce across the metro.

Sales fundamentals remain particularly tight. “We are still in a very scarce market for sales,” says Harnden. “Prices are coming back, and we expect new records on a land-per-square-foot basis in 2026. Both sales and leasing demand are trending upward, with pricing finally starting to follow.” Scarcity of clean, functional infill sites continues to underpin investor confidence and pricing strength.

Supply constraints remain the primary challenge. Zoning and entitlement hurdles, environmental considerations, and functional obsolescence limit the pool of viable IOS properties. Harnden adds that “quality infill sites are increasingly difficult to find that are not functionally obsolete, environmentally challenged, or caught in an entitlement quagmire. While the Twin Cities face IOS supply constraints compared to markets nationwide, that scarcity creates a strong and steady IOS market.” Despite these challenges, a steady stream of both on-market and off-market opportunities continues to transact.

Redevelopment pressures are further emphasized in the Minneapolis Comprehensive plan, where more stringent IOS requirements will be realized around the city and river area. For IOS owners along the Mississippi River in Minneapolis, the Mississippi Corridor Critical Area (MCCA) overlay does not prohibit outdoor storage but significantly restricts visibility, expansion, and intensification, often requiring added screening, landscaping, runoff controls, and discretionary approvals. In practice, this raises entitlement risk and costs for new or expanded IOS uses while reinforcing long-term scarcity and value for existing, compliant sites.

See Appendix A – Mississippi Corridor Critical Area Plan, Minneapolis 2040 Comprehensive Plan.2

This supply-constrained environment — combined with re-accelerating demand, limited new development, and strong investor interest — positions Minneapolis–St. Paul alongside other mature IOS markets. Even amid broader industrial normalization, IOS performance in the Twin Cities continues to be driven by long-term fundamentals rather than short-term cycles.

The Bottom Line:

Minneapolis–St. Paul’s IOS market remains tight and structurally constrained. Limited entitled land, fragmented zoning, and ongoing redevelopment pressure continue to restrict supply, while rising leasing momentum and renewed sales activity support stable rental rates and strengthening pricing for functional infill sites. For well-located IOS assets, the Twin Cities offer scarcity-driven value and durable long-term demand.

IOS LISTINGS

Minneapolis Listings

Don’t miss the active IOS listings in Minneapolis.

See active listings here.

LOCAL EXPERTS

Local Brokers & Market Experts

Big thanks to all participants who helped shape this week’s Market Monday in Minneapolis. If you’re looking to buy, sell or lease in Minneapolis, the people below are the ones to call!

JLL

Dan Larew

Managing Director

e: [email protected]

p: 612 217 6726

Eric Batiza

Managing Director

e: [email protected]

p: 612 217 5123

Jack Nei

Associate Broker

e: [email protected]

p: 651 200 8011

CBRE

Myles Harnden

Vice President

C 469 235 3509

E: [email protected]

Hunter Weir

Associate Broker

C 834 422 0660

E: [email protected]

IOS Resources

Check Out Our Free IOS Underwriting Model Tool

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.