Market Monday: Jacksonville, FL

In today’s email:

Market Overview: Jacksonville’s population has grown 23% over the past decade, one of the fastest rates in the U.S., supported by rising household incomes and strong in-migration. As of Q3 2024, industrial vacancy sits in the mid-4% range, with demand fueled by JAXPORT, freight corridors, and construction-driven logistics. The metro’s position at the crossroads of I-10 and I-95 makes it a natural distribution hub for Southeast freight traffic.1

The IOS Opportunity: Lease rates initiated between 2022 and 2025 average ~$4K per acre per month, with rent rates per acre increasing ~6-10% annually from leases initiated in 2022 to 2025. IOS land prices can range from $600K–$800K per acre, with prices attracting a premium on the I-10 corridor west of the city.

Market Fundamentals: Jacksonville port infrastructure, FTZ-64 benefits, and growing import–export volumes reinforce Jacksonville’s role as a key multimodal gateway.

IOS Landscape: IOS sites are concentrated near Downtown, Riverside, the Westside, and along I-10, where trucking, drayage, equipment rental, and construction material users cluster. Site configurations range from compact infill yards near the port to expansive multi-acre facilities along major freight corridors. Jacksonville offers hundreds of viable IOS sites, giving both users and investors room to scale — a rarity among high-growth metros. Most properties feature fenced, lit yards with gated access, while higher-spec sites include wash bays, shop space, utilities, and heavy truck infrastructure.

Local Brokers & Market Experts: Scroll to the bottom for a list of active IOS listings and experts shaping the Jacksonville market — special thanks to Matthews, Colliers, and Franklin St. for participating!

Notable: Mike Salik at Matthews published an IOS-specific report in 2024 that is definitely worth a look.

MARKET OVERVIEW

Jacksonville

Jacksonville is one of the fastest-growing major metros in the U.S., expanding its population by 23% from 2013–2023, far exceeding both state and national growth rates and is expected to grow its population 11% from 2023 to 2028. This surge is supported by rising household incomes — now $3,000 above the national average — and a diversified economy tied closely to logistics, construction, and port-driven trade.1,2

The Northeast Florida region is one of the few East Coast regions with all four logistics pillars—rail, air, maritime, and highway. Jacksonville serves as a major rail hub for CSX, Norfolk Southern, and Florida East Coast Railway, and the region is connected nationwide via I-95, I-10, and I-75.3

Jacksonville’s geography and infrastructure give it a uniquely strong logistics position. Mike Salik of Matthews explains:

“The city’s strategic location at the crossroads of I-10 and I-95 makes it the natural freight link between the Port of Long Beach on the West Coast and East Coast distribution hubs. This direct cross-country corridor funnels import-export traffic through Jacksonville, drawing heavy trucking, logistics, and drayage operators to the region.”

Source: Cushman & Wakefield MarketBeat Jacksonville Industrial

These national freight movements converge with JAXPORT, which serves as one of the Southeast’s most efficient, fast-growing container ports. It is one of the region’s two deep-water ports and the top container port complex in Florida. JAXPORT is also one of only 17 U.S. ports authorized to move military cargo, and the only one in Florida, making it a strategic hub for defense logistics.4

JAXPORT’s Foreign Trade Zone 64, offering duty and tariff advantages, strengthens the region’s role as a global trade gateway, attracting shippers, third-party logistics groups, container operators, automotive processors, and e-commerce distributors. Industrial activity clusters around JAXPORT, along the I-295 loop, and throughout the I-10 Westside corridor — all key hubs for IOS demand.

IOS OVERVIEW

Jacksonville IOS Opportunity

Industrial Outdoor Storage has become a rapidly growing and increasingly strategic asset class in Jacksonville’s industrial landscape. The surge in port activity, population growth, and construction staging needs has created consistent demand for both small infill yards and large multi-acre logistics sites across the metro. As Mike Salik of Matthews notes:

“Jacksonville’s IOS market remains strong, supported by steady tenant demand from logistics, construction supply, and equipment rental users near JAXPORT and the I-95/I-295 corridors. As the largest city by land area in the continental U.S., Jacksonville offers hundreds of viable IOS sites—creating both depth of supply and attractive entry points for investors seeking scale in a market with room to grow.”

Recent transaction patterns echo this sentiment. Sales activity remains light with limited opportunities, as most trades have been owner-user acquisitions, and true investment sales remain minimal. Gordon Olson of Colliers notes, investor interest is clearly shifting: “Investor appetite for both single and multi-tenant IOS assets has noticeably increased.”

Leasing activity tells more of the story. Across leases evaluated from 2023 to 2025, ~60% were with trucking/logistics companies paying roughly ~$3.9K per month per acre on average. Trucking/Logistics users tended to occupy larger 8–9+ acre yards. Commercial services represented the next largest share at ~25%, with yard sizes smaller (2-4 acres) and lease rates per acre per month of $4-$5K, slightly higher than trucking/logistics.

Olson notes that demand is strengthening among smaller local tenants seeking 3-acre sites on short-term or month-to-month terms, and that several national credit tenants are paying competitive rates for 10–20+ spaces and remaining for 1–2+ years. “While vacancy across traditional IOS sites remains elevated, demand from local and national credit tenants has increased for 3–5-acre yards with 5k–10k SF service shops. Lease rates for these improved sites are holding strong due to limited supply, while traditional yards are averaging around $3,650 per acre per month.”

Site configurations also vary widely across the metro. Salik explains:

“IOS properties in Jacksonville range from fully improved asphalt-paved yards — ideal for truck, trailer, and container storage — to stabilized base lots using crushed aggregate or limestone that serve construction supply and equipment rental users. Many sites feature perimeter fencing, gated access, and security lighting, while higher-end facilities often include utilities, wash bays, and small maintenance shops.”

Challenges remain modest compared to more constrained markets like California, but land-use pressure is increasing in certain infill areas as the city redevelops older industrial corridors. While Jacksonville benefits from abundant land relative to peer metros, competition for well-located IOS near JAXPORT and I-10/I-95 is tightening as logistics and drayage operators expand.

The bottom line:

Jacksonville’s IOS market is defined by port-driven demand, population growth, multimodal freight access, and a uniquely deep inventory of viable sites. With rents rising, transaction volume accelerating, and users increasingly viewing yard space as core logistics infrastructure, Jacksonville stands out as one of the most scalable and investable IOS environments in the Southeast — offering both near-term demand and long-run growth capacity.

FEATURED LISTINGS

Jacksonville

6829 Old Kings Rd | For Lease

This 7.5-acre light industrial outdoor storage site near I-295 and US-23 offers flexible yard configurations with the ability to subdivide. The property is fully fenced, stabilized with crushed concrete, and features perimeter lighting, security cameras, and utilities including well and septic. With a mix of improved surfaces and ample paved areas, it is well suited for a wide range of IOS users, including equipment storage, trucking, and contractor yards.

Please reach out to Eric Bumgarner, Michael Cassidy, and Gordon Olson for more information.

120 Gun Club Rd | For Lease

This 5.3-acre light industrial outdoor storage site in Jacksonville’s Northside submarket offers excellent access to US-17, I-95, and major regional transport hubs, including JAX Airport and the I-295 beltway. The yard is fully fenced with an electric gate and perimeter lighting, providing secure and flexible space for a wide range of IOS users. Its strategic location along N Main Street and Gun Club Road makes it ideal for logistics, trucking, and staging operations.

Please reach out to Eric Bumgarner, Michael Cassidy, and Gordon Olson for more information.

11853 New Kings Road | For Lease

This 3.07-acre IOS parcel sits at the front of a newly developed 22-acre industrial complex along US-1, offering secure, fully fenced storage with gated access and perimeter lighting. The yard is stabilized with 6" of crushed concrete and includes electric and water hookups, with room to place an office trailer for on-site operations. Located just five miles north of I-295, it is ideal for fleet parking, contractor storage, or equipment staging in Jacksonville’s Northside submarket.

Please reach out to Eric Bumgarner, Michael Cassidy, and Gordon Olson for more information.

9850 New Berlin Road | For Lease

This 4.5± acre industrial and commercial outdoor storage site offers exceptional connectivity to JAXPORT, the Dames Point Marine Terminal, and I-295, making it one of the most strategically positioned yards in Jacksonville’s Northside submarket. The site is fully secured with perimeter fencing, gated access, pole lighting, reefer plugs, and a crushed-rock surface, plus a 1,200 SF on-site office trailer. With zoning for Industrial Waterfront (IW), the property supports marine, logistics, transportation, and industrial storage uses aligned with the region’s growing port-driven demand.

Please reach out to Eric Bumgarner, Michael Cassidy, and Gordon Olson for more information.

11864 Camden Road | For Lease

This 4± acre light industrial outdoor storage site offers excellent access to I-295 and I-95, making it a strong logistics location in Jacksonville’s Ocean Way/Northside submarket. The yard is fully secured with 8' perimeter fencing, a 30' double roll gate, LED floodlighting, and a 6" crushed concrete base suitable for truck and equipment parking. Zoned IL, the site is versatile and supports a wide range of uses including IOS storage, managed truck parking, warehousing, and distribution.

Please reach out to Eric Bumgarner, Michael Cassidy, and Gordon Olson for more information.

7775 Old Kings Rd | For Sale

Located just off I-295, this high-and-dry 29-acre parcel offers a prime industrial development opportunity with rail frontage and strong connectivity to Jacksonville’s logistics network. The property is currently zoned residential, but local leadership is supportive of a rezoning to Heavy Industrial, unlocking a wide range of uses. With an asking price of $240K per acre, the site sits between major arterials and provides exceptional access for IOS or warehouse users.

Please reach out to Shaun Mayberry, Giovanny Castano, Keith Wood, and Cooper Folds for more information.

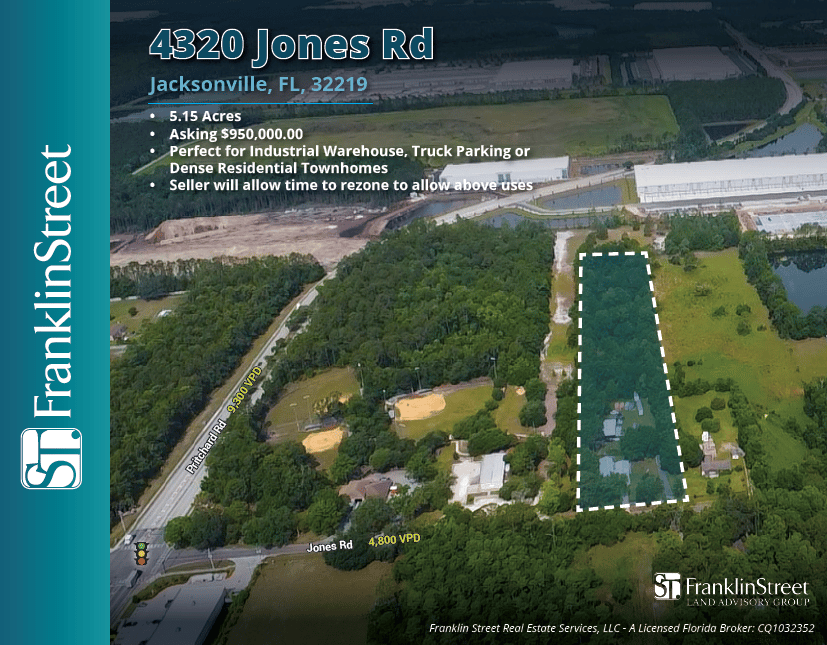

4320 Jones Road | For Sale

4320 Jones Rd offers 5.15 acres of infill land positioned near heavy industrial users and key transportation routes. Priced at $950K, the site can accommodate multiple development paths—including warehouse, fleet/yard uses, or residential density—with the seller open to rezoning to support the buyer’s intended plan.

Please reach out to Shaun Mayberry, Giovanny Castano, Keith Wood, and Cooper Folds for more information.

RECENT DEALS FEATURED

Jacksonville

ACQUISITION: A 28,734-SF single-tenant industrial service facility on 3.0 acres at 5919 Commonwealth Ave. in Jacksonville, FL was acquired. The seller acquired the property in August 2024, completed significant renovations, secured a long-term lease, and exited just 15 months later. Colliers represented the parties in the transaction.

ACQUISITION: COARE Industrial acquired a 2.87-acre IOS property at 321 Lane Ave N in Jacksonville, featuring a 12,268 SF warehouse with office space and twelve drive-through doors. Zoned for all types of outdoor storage, this marks COARE’s first Jacksonville IOS acquisition and third in Florida. The property, delivered vacant on a short-term basis, is available for lease with planned improvements coming soon.

LEASED: Criterion Group announced that FedEx leased 11643 103rd Street in Jacksonville, FL. The site featured an existing 2,800 SF building on a 7 AC property with over 4 AC of usable space. Richard Ryan and the Fischer team facilitated this lease!

ACQUISITION: 17339 Brandy Branch Rd in Jacksonville, FL was just sold! This IOS property features over 14K SF across 2 buildings on 10 AC. The site is strategically located near I10 and I295. Mike Salik at Matthews Real Estate Investment Services facilitated this deal!

ACQUISITION: Greenspring Realty Partners closed on an off-market property located at 5011 Vernon Road in Jacksonville, FL. This was a competitive process with multiple buyers in the mix, but Greenspring’s flexibility, creativity, and aggressive approach helped them win the deal, move quickly through diligence, and secure a quality new tenant. PVE USA is the tenant at 5011 Vernon Road.

ACQUISITION: The STRO Cos. and KRE Group have expanded their Florida industrial portfolio by acquiring two properties through a sale-leaseback transaction. The assets include a 20,380-square-foot building at 425 Hobbs St. in Tampa and a 22,887-square-foot facility at 558 Stuart Lane in Jacksonville, both featuring additional land for outdoor storage. This strategic move enhances their presence in high-growth Southeastern markets and aligns with their focus on functional, well-located industrial assets.

5109 W Beaver, Jacksonville, FL

ACQUISITION: Zenith acquired 3AC site at 5109 W Beaver in Jacksonville, FL. Site is strategically situated between I-295 and I-95 and less than 10min from downtown Jacksonville.

ACQUISITION: 5753 Blanding Blvd, Jacksonville, FL 32244 was recently sold! Prime Blanding Blvd frontage with 28,000+ VPD, 1.02 Acres, and 5,104 SF Freestanding Building.

LOCAL EXPERTS

Local Brokers & Market Experts

Big thanks to all participants who helped shape this week’s Market Monday in Jacksonville. If you’re looking to buy, sell or lease in Jacksonville, the people below are the ones to call!

Matthews

Mike Salik

Senior Vice President

O 904.322.7602

C 904.838.6603

[email protected]

Colliers

Eric Bumgarner

Executive Vice President

C 904.861.1152

[email protected]

Michael Cassidy

Senior Associate

C 904.861.1120

[email protected]

Gordon Olson

Associate

C 904.487.5562

[email protected]

Franklin Street

Shaun Mayberry

Senior Director

P: 904.899.0310

[email protected]

Cooper Folds

Associate

P: 229.947.3436

[email protected]

SOURCES & REFERENCES

IOS Resources

Check Out Our Free IOS Underwriting Model Tool

Property Listings (For Sale or Lease) – Submit Here

Get your property in front of qualified buyers and tenants actively searching for Industrial Outdoor Storage opportunities.

📰 SHARE YOUR COMPANY NEWS Got industry news to share? Email us at [email protected] with your company updates and announcements.

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.