Market Monday: Tampa, FL

Summary:

Market Overview: Tampa’s population growth continues to outpace national averages, driven by strong in-migration, rising household incomes, and sustained economic expansion across Central Florida. Industrial vacancy remains tight, hovering near historical lows even as new construction hits the market, with demand fueled by Port Tampa Bay, the I-4 corridor, and the region’s expanding base of contractors, service providers, and logistics users. Tampa’s position along I-4 and I-75 makes it a natural hub for freight, last-mile distribution, and statewide coverage.1,2

The IOS Opportunity: Lease rates initiated between 2024 and 2025 spanned $5-10K per acre per month, with an average price per acre per month of ~$7K. IOS land prices increased ~28% price per acre from 2023 to 2025. In 2025, purchase prices sampled range from $600K–$1M+ per acre.

Market Fundamentals: Tampa’s multimodal infrastructure — centered around Port Tampa Bay, I-4, I-75, CSX rail service, and growing container and bulk cargo volumes — continues to reinforce the region’s role as a key logistics gateway. Just as important as where the market is today, is what will Tampa be in 2040?1,3

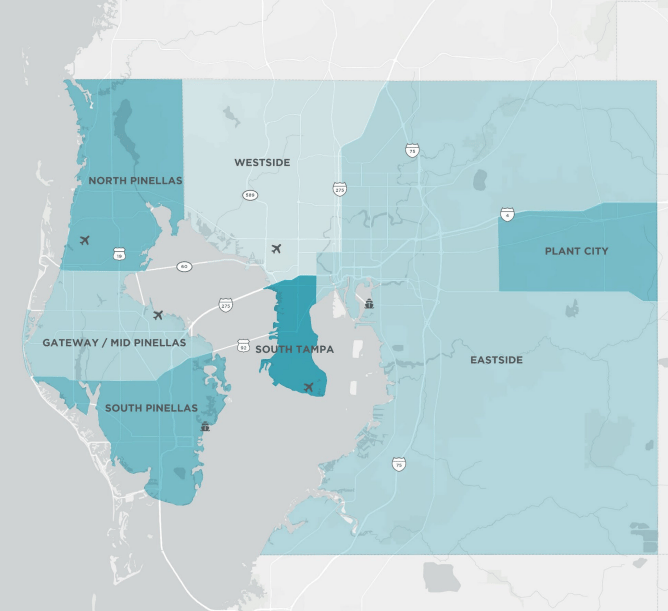

IOS Landscape: Tampa’s IOS activity clusters around Port Tampa Bay, the Ybor/Adamo corridor, East Tampa, Brandon/Seffner, and the I-4 spine, where trucking, drayage, equipment rental, utilities, and construction-material users concentrate. Inventory ranges from small infill yards near the port to larger multi-acre sites east of I-75, where zoning and land availability are more flexible. Most properties offer fenced, lit, gated yards, while more improved sites feature shop space, utilities, stabilized surfaces, and heavy-truck infrastructure. The market’s main challenge is structural: limited industrial land, zoning pressure, and scarce infill supply have created one of the Southeast’s tightest IOS environments, driving strong competition for functional sites of all sizes.

Local Brokers & Market Experts: Scroll to the bottom for a list of active IOS listings and experts shaping the Tampa market — special thanks to Lee & Associates, Lober Real Estate, and Franklin Street for participating!

MARKET OVERVIEW

Tampa

Tampa’s industrial market continues to punch above its weight, supported by strong in-migration, a diverse employer base, and one of Florida’s most active logistics corridors. The metro benefits from direct access to I-4, I-75, and Port Tampa Bay, with a distribution ecosystem built around e-commerce, building materials, HVAC/MEP contractors, and regional service providers. The port’s expanding container and bulk-cargo capabilities have also reinforced Tampa’s role as a strategic gateway for Central and Southwest Florida.

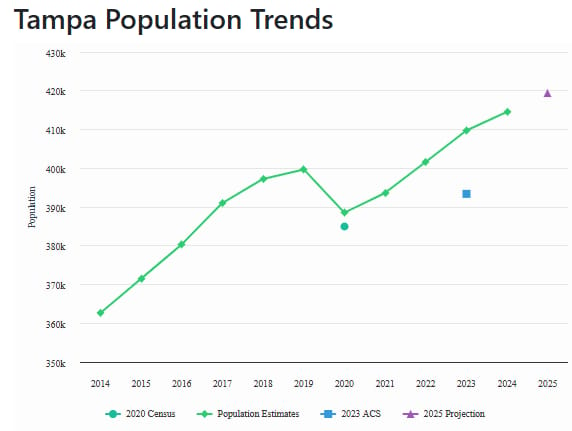

Population growth remains one of Tampa’s defining tailwinds, with Hillsborough, Pasco, and Polk among the fastest-expanding counties in the country according to the US Census. This demographic momentum supports a healthy labor pool, low unemployment, and steady demand from transportation groups, contractors, service providers, and other IOS-heavy users. As a result, occupiers increasingly view Tampa as a long-term strategic base for Florida—not just an alternative to Orlando or Jacksonville.

Industrial fundamentals mirror this momentum: core submarkets continue to post vacancy rates below the national average, construction pipelines remain limited, and absorption is fueled by users seeking regional reach across Florida. As Devin Beeler of Lober Real Estate noted, “2025 was another strong year in the IOS sector. We saw a steady influx of new-to-market tenants taking space throughout Central & West Florida - demand continues to remain strong. While most executed deals were completed with regional operators in the building supplies and contractor related industries, we did see a notable splash of national credit tenants continuing to enter the market as well. The bulk of IOS absorption occurred in Q2 and Q3 of 2025. We’re proud to represent some of the nation’s largest IOS companies, and we believe 2026 is positioned to start off hot.”

IOS OVERVIEW

Tampa IOS Opportunity

Tampa’s geography, environmental constraints, and zoning hurdles have created a structurally undersupplied IOS market where functional, well-located sites trade and lease quickly. Tenant demand remains robust across equipment rental, transportation, freight, construction trades, utility contractors, and building-materials groups — the same users driving IOS absorption across most high-growth Sunbelt markets.

Erika Thompson of Lee & Associates notes the continued strength of the market:

“The Industrial Outdoor Storage (IOS) sector in the Tampa market continues to show strength, with tenant demand and overall activity remaining high. Investor appetite for well-located, infill IOS sites has pushed pricing to impressive levels, with recent sale transactions averaging $1 million per acre. Rental rates have held steady, with infill properties generally commanding between $7,000 and $10,000 per acre per month, depending on the size of the building. Although we have seen deals taking longer to get over the finish line the past 5–6 months, overall Tampa’s IOS market remains resilient, fueled by persistent tenant demand for premium infill locations within a land-constrained environment.”

Sale pricing continues to climb as industrial land becomes increasingly scarce. In 2023, the average price per acre sat around ~$720K; by 2025, that figure had risen to ~$925K. Multiple owner-users have crossed the $1M+ per acre mark, particularly in infill locations. Core Tampa tends to fetch $750K+ per acre, while nearby cities like Port Richey (US-19), Plant City (I-4), and Sarasota offer more cost-efficient alternatives with room to scale.

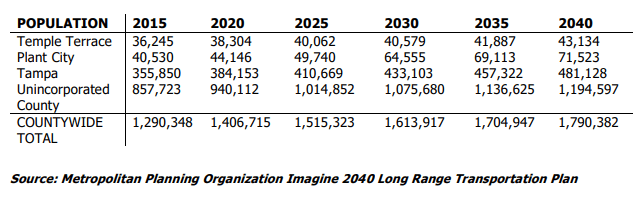

Understanding Tampa’s development trajectory also matters when making long-term investment decisions. Submarkets experiencing outsized population growth or increased density are likely to see IOS demand deepen over time. Plant City, for example, is projected to nearly double in population by 2040. While you never underwrite solely on growth projections, investing “where the puck is going to be” is better than the alternative. The Tampa 2040 Comprehensive Plan outlines much of this future direction.

Brad Hutton of Franklin Street highlights the demand dynamics and growing scarcity across the metro:

“Demand for IOS sites across Tampa Bay and the I-4 corridor remains strong, driven by transportation, utility contractors, fleet operators, and logistics users who value well-located low-coverage land near major arterial corridors. In Pinellas County — the most densely populated county in Florida — infill IOS opportunities are increasingly scarce, leading to record pricing and heightened competition for small-format yards.”

Zoning and land scarcity remain defining constraints. Many localities in Hillsborough and Pinellas have tightened outdoor-use allowances, pushing fleet users and contractor groups east toward Brandon, Plant City, and Lakeland. As Hutton notes:

“The biggest constraint in Tampa is not demand — it’s zoning and permitting. Many industrial districts have already transitioned to flex/retail or residential pressure zones, so fully entitled IOS yards with utilities and access to truck routes are trading at a premium. Additionally, paving and stormwater requirements continue to push development timelines and carry costs upward.”

This tightening regulatory environment mirrors patterns we’ve seen in Charleston, Denver, and Nashville — early-stage IOS constraint cycles that precede accelerated rent and land-price growth. Tampa is now entering that same phase. Competition remains intense for paved or improved yards under five acres, and even basic gravel lots near the port or contractor corridors (US-301, Causeway, I-4) continue to lease quickly simply due to scarcity.

The Bottom Line:

Tampa’s IOS market remains one of the strongest and most supply-constrained in the Southeast — defined by infill scarcity, zoning pressure, and persistent tenant demand for well-located, functional outdoor storage.

FEATURED LISTINGS

Tampa

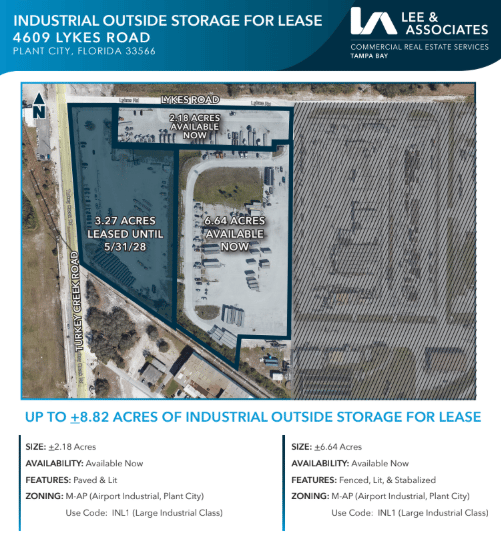

Lee & Associates

Please reach out to Erika Thompson and Ben Ewers for more information on the below.

4609 Lykes Road | For Lease

Up to 8.82 acres of fenced, lit, and stabilized IOS space are available for lease in Plant City across multiple yard sizes. The site offers M-AP zoning with immediate availability along Lykes Road.

10490 Gandy Blvd N. | For Lease

The site offers 10.91 acres of paved parking directly off Gandy Boulevard in St. Petersburg, adjacent to the Derby Lane property. Its size and location make it well-suited for fleet parking, vehicle storage, or large-scale outdoor operations.

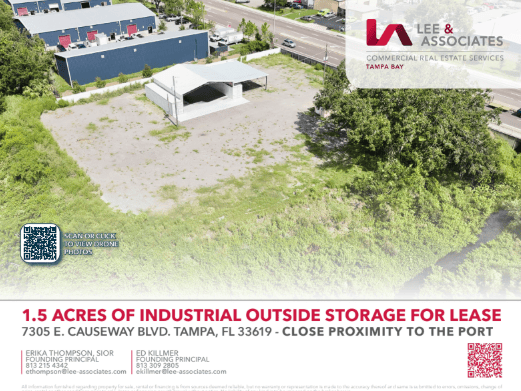

7305 E. Causeway Blvd. | For Lease

The site offers 1.5 acres of IOS on E. Causeway Blvd., minutes from Port Tampa Bay and major transportation routes. With utilities, covered storage, cargo containers, and a pole barn onsite, it’s well-suited for operators needing secure, functional, and accessible outdoor storage space.

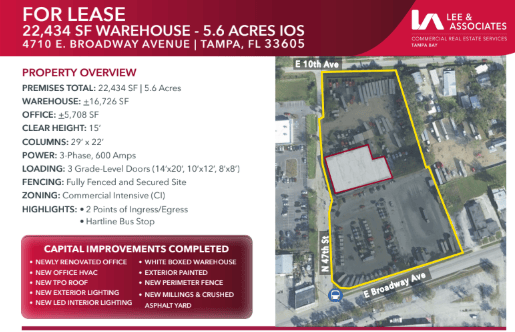

4710 E. Broadway Ave | For Lease

The property features a 22,434 SF warehouse on 5.6 acres of fully fenced and secured IOS along E. Broadway Avenue, offering multiple grade-level doors, 15’ clear height, strong power, and two points of ingress/egress. Recent upgrades—including new office space, exterior paint, LED lighting, and resurfaced yard—make it a turnkey option for users needing both functional warehouse space and expansive outdoor storage.

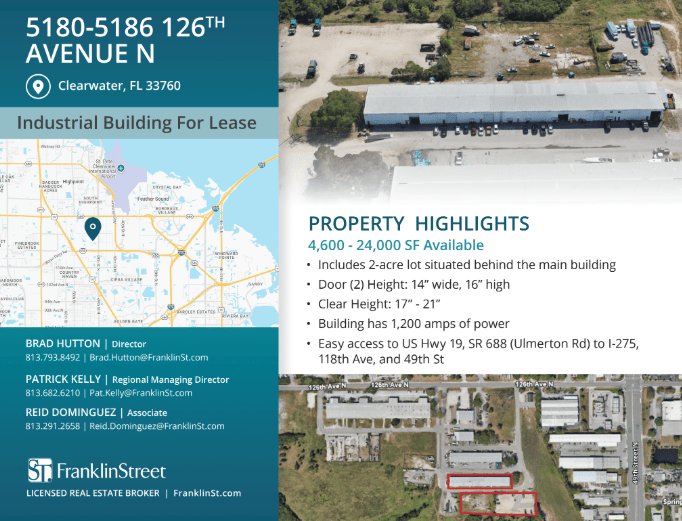

Franklin St

Please reach out to Brad Hutton, Pat Kelly and Reid Dominguez for more information on the below.

You can also view all Franklin St active Tampa IOS listings here. A few highlighted below as well.

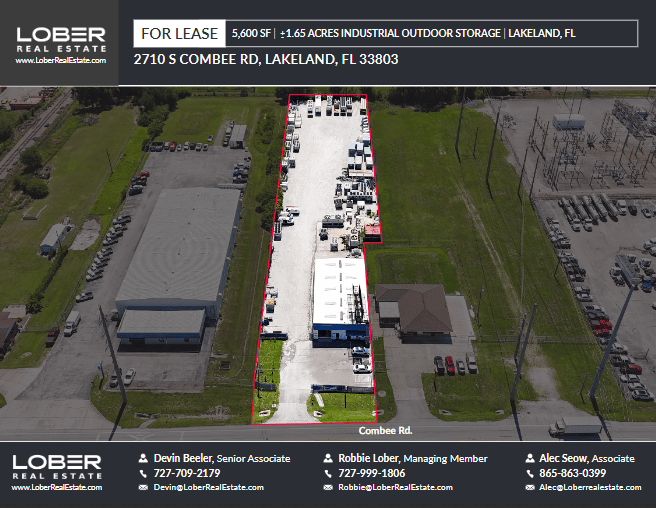

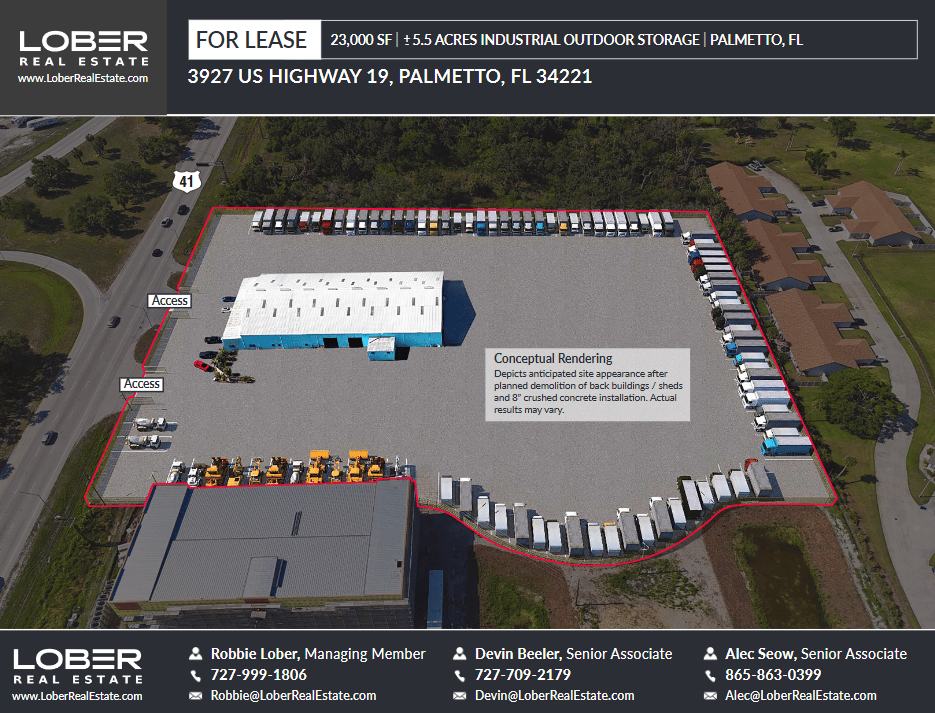

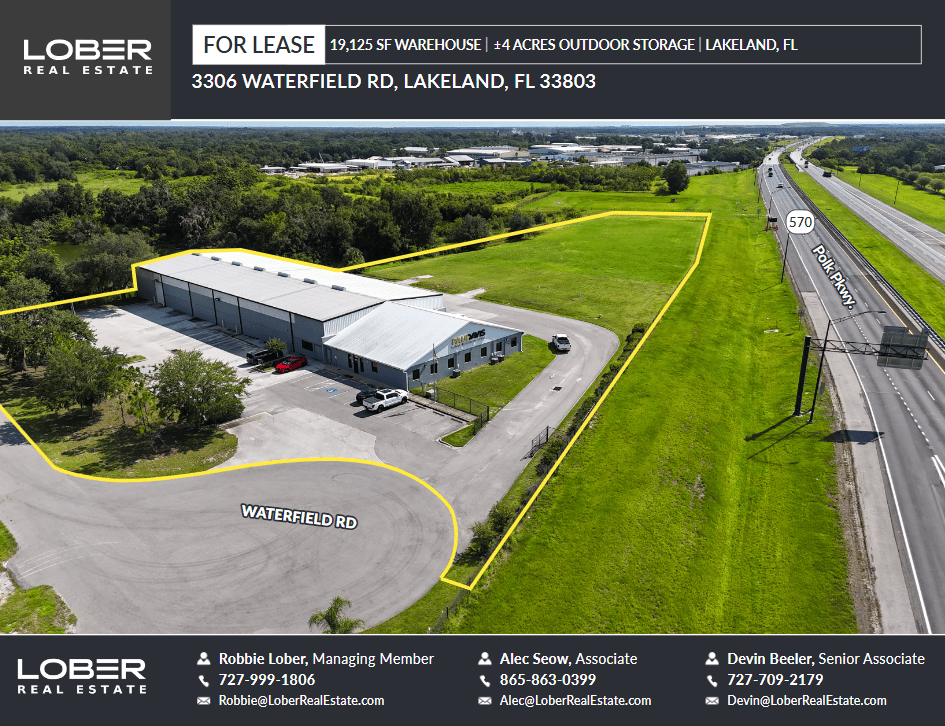

Lober Real Estate

Please reach out to Robbie Lober and Devin Beeler for more information on the below.

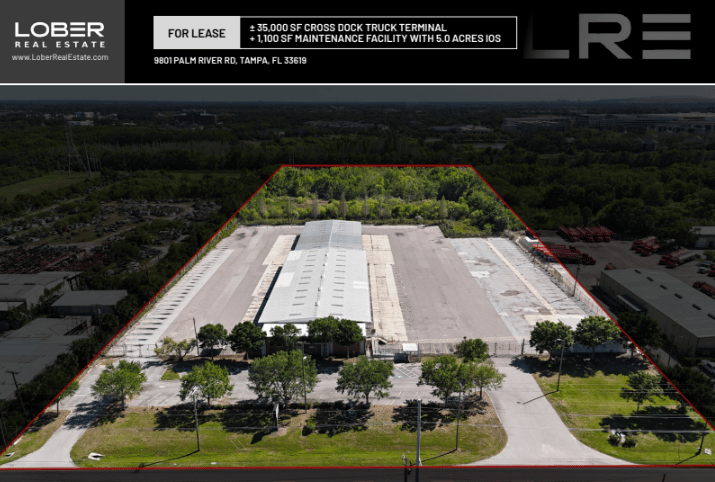

9801 Palm River Road | For Lease

This East Tampa offering features a ±35,000 SF cross-dock truck terminal with 77 high-position docks, a ±1,100 SF maintenance facility, and ±5.0 usable acres of IOS on a ±10.4-acre site. With M-manufacturing zoning, full circulation, gated access, and immediate functionality for logistics and truck-related operations, it’s a rare large-scale IOS terminal. Check out the full listing here.

7405 & 7411 28th St E | For Lease

This Sarasota site totals 11.8 acres across four buildings (±24,367 SF + ±8,000 SF configurations) with 18–20 ft clear heights, nine grade-level doors, and three points of ingress/egress. Zoned Light Manufacturing, it offers flexible warehouse and yard layouts suitable for contractors, equipment users, and industrial outdoor operations, and is available immediately. Check out the full listing here.

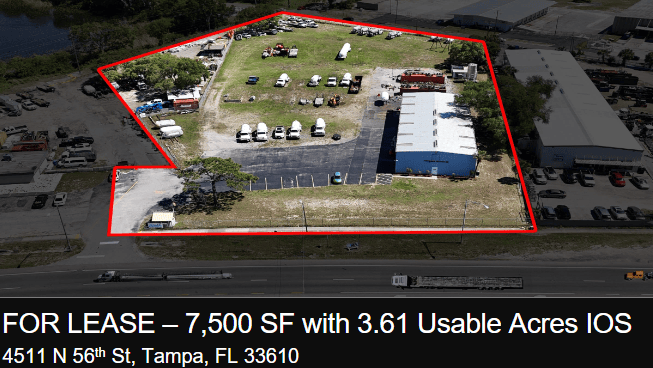

4511 N 56th St | For Lease

This East Tampa industrial site offers a 7,500 SF building (with 1,000 SF office) plus 3.81 acres of fenced outdoor storage, featuring multiple grade-level doors, 22' clear height, and heavy power. With M-Manufacturing zoning and direct access to major highways and the Port, it’s a turnkey IOS yard ideal for trucking, equipment, and service-oriented users. Check out the full listing here.

5504 15th St E | For Lease

This Bradenton offering includes an 8,390 SF warehouse with a 5,000 SF covered awning and 4.5 acres of fenced IOS, featuring five grade-level doors, 12–20 ft clear height, and heavy power. Zoned Light Manufacturing and available now, it provides a functional blend of indoor service space and expansive yard suited for equipment, fleet, and contractor users. Check out the full listing here.

RECENT DEALS FEATURED

Tampa

ACQUISITION: Marcus & Millichap has closed the sale of a 2.92-acre IOS site at 7021 E Broadway Ave in Tampa, FL. The property is 100% leased to a national tenant and is located just 10 minutes east of downtown in an Industrial Heavy zoning district. Congrats to Noah Zuckerman on facilitating this one.

ACQUISITION: Lober Real Estate closed the sale of an IOS property at 5907–6001 E Columbus Dr. in East Tampa, FL. The 1.73-acre site includes an 11,020 SF warehouse and drew strong interest from both buyer and seller, with the deal successfully navigated to closing.

ACQUISITION: Greenspring Realty Partners (GRP) has acquired 7810 Professional Place in Tampa, FL, a 14,434 SF heavy industrial facility on 2.32 acres, featuring four drive-in doors and highly functional space for service-based industrial users. The property was fully leased prior to closing, reinforcing their proactive approach to sourcing and securing high-quality tenants ahead of acquisition.

ACQUISITION: JLL’s Tampa team announced the off-market sale of 8419 Sabal Industrial Blvd, a 72,612 SF industrial facility on 7.13 acres in East Tampa. The property is leased to Phillips Manufacturing Co. and features dual ingress/egress points plus a CSX rail line, making it a strong addition to Jadian IOS’s Central Florida portfolio. The deal was executed in partnership with Alex Stahl, Daniel Schuchinsky, and the Jadian team.

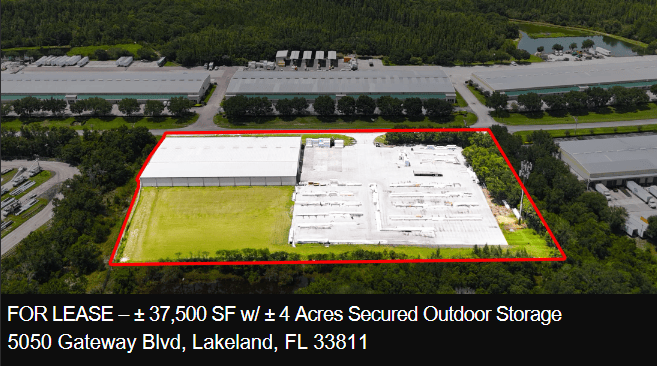

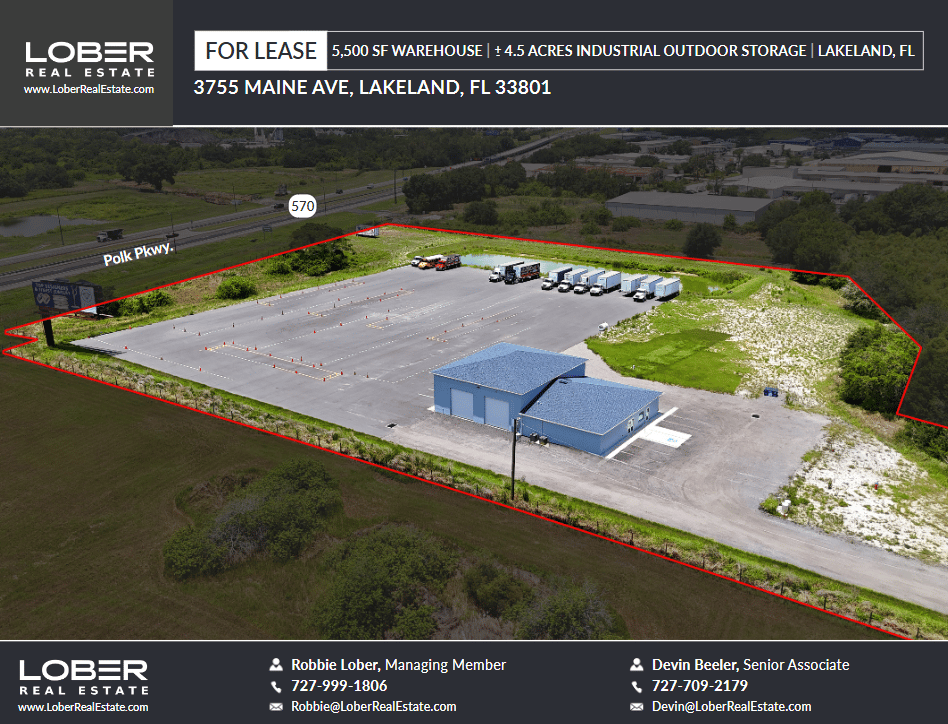

ACQUISITION: Alterra IOS acquired 3755 Maine Avenue in Lakeland, FL (Tampa MSA)—a 4.5-acre industrial outdoor storage site with a 5,400 SF maintenance building, proximate to Polk Parkway and US-98, and available for immediate occupancy.

LEASED: JLL announced three new IOS leases in Tampa with client Jadian IOS, underscoring strong demand for outdoor storage space in the market. The sites leased include 6601 N 50th St. (3.67 acres, 14,500 SF), 6801 E. Adamo Dr. (2.17 acres, 14,500 SF), and 6601 E. Adamo Dr. (2.26 acres, 17,500 SF). JLL handled leasing and acquisitions for the transactions.

LOCAL EXPERTS

Local Brokers & Market Experts

Big thanks to all participants who helped shape this week’s Market Monday in Tampa. If you’re looking to buy, sell or lease in Tampa, the people below are the ones to call!

About Lee & Associates Tampa Bay: Lee & Associates Tampa Bay is a broker-owned commercial real estate firm with award-winning, diverse professionals who deliver transparent, client-focused brokerage across industrial, office, retail and land assets throughout Florida. Learn more about Lee & Associates Tampa Bay

Reid Dominguez

Associate

813.992.6808

[email protected]

Learn more about Franklin St Tampa here

Robbie Lober

727.999.1806

[email protected]

Devin Beeler

727.709.2179

[email protected]

LOCATION, LOCATION, LOBER! Learn more about Lober Real Estate here.

SOURCES & REFERENCES

IOS Resources

Check Out Our Free IOS Underwriting Model Tool

Have active IOS listings? Send to [email protected]

Want priority placement? Boost Listing for immediate exposure

Disclaimer: The authors of IOS YardDogs are not finance or tax experts. We love big yards, small buildings. This email is for educational uses and is not financial / investment advice. Please conduct independent research and consult with industry professionals before making financial or investment decisions. Our content, which may contain affiliate links, is subjective and not to be used as the only basis for such decisions. We are not responsible for any losses from relying on this information.